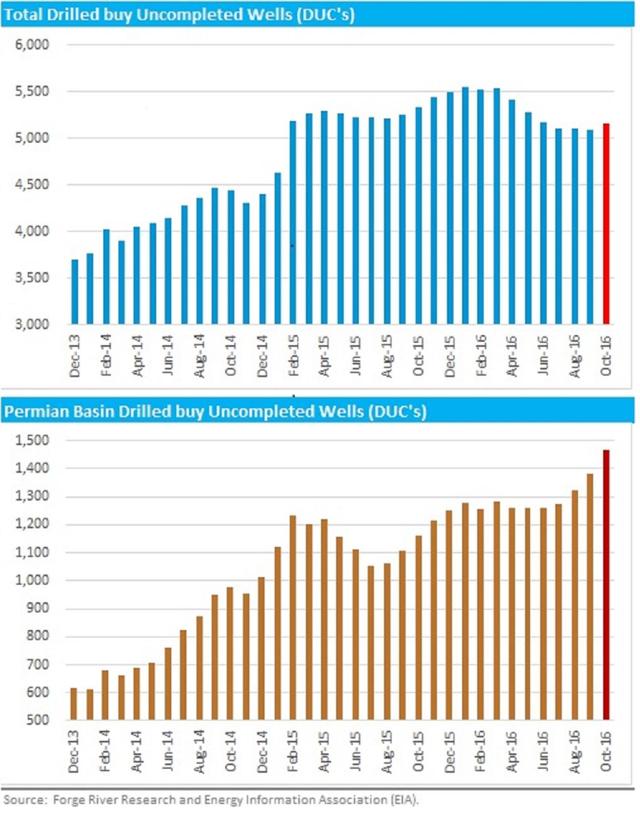

For the first time in seven quarters, the total number of drilled but uncompleted wells (DUCs) in America grew. The Energy Information Association (EIA) recently began publishing information on the number of DUCs. The number of DUCs has grown significantly since oil prices collapsed two years ago. Oil market participants have been increasingly concerned regarding the potential overhang DUCs create for an oil price recovery.

Should oil prices recover, DUCs (which can be quickly completed and start producing oil) might flood the market with supply. That would keep oil prices range-bound and below sustainably profitable levels for U.S. shale oil producers. The primary driver of the growth in DUCs is the Permian Basin (as seen in the chart below, taken from the Energy Information Association's "Drilling Productivity Report - DUC Wells by Region").

The Permian Basin has been the subject of many claims with regard to the amount of oil available for recovery with the application of horizontal drilling and hydraulic fracking. A Wall Street starved for yield and growth opportunities has noticed. Further claims regarding the improvements in these technologies and the impacts they've had on higher initial production rates and flattened decline curves have sent a gusher of Wall Street capital into Permian plays.

This massive influx of capital from investors into companies focused on the Permian Basin and acreage acquisition funding has driven growth in drilling activity (i.e., rig counts) and a buying spree driving up acreage acquisition and stock prices to all-time highs. Clayton Williams Energy, Inc. (CWEI), a Permian Basin pure play, has seen its market capitalization soar 2,668%. That is greater than 26x. (Its stock hit a 17-year low on March 20, 2016, of $6.25 with 12.17 million shares outstanding, and on Nov. 15, 2016, its stock hit an intra-day high of $117.90 with