Petrobras (NYSE:PBR) has been a great stock to own for the past year. With a 215% price increase on its stock in a year. The stock has rebounded to 11.28 from past years low ($3.5 USD). This has left investors wondering: Will the price rise further?

Petrobras Price/Book is at 0.98x and Price/EBITDA is at 5.33x. With such ratios, one would think the stock is a compelling buy. Supporting that argument is a market capitalization lower than a year of sales (0.71 Price/Sales) and many other valuation metrics that are way below the oil industry.

I believe the actual price of the company does not reflect current financial conditions. At 11.54 USD per share, the stock is trading at levels that were seen when WTI prices traded at 100 USD/Barrel. It is true the worst for the company has passed, but there are some issues that must be considered before thinking on holding or buying the stock.

Risk 1: Petrobras is still close to bankruptcy.

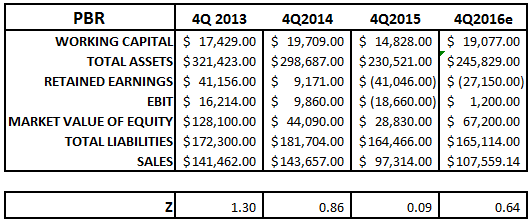

The company has been on the verge of bankruptcy for a couple years. Even though its situation has improved, financial conditions remain very vulnerable. One of the most common ways to asses if a company is under financial pressure is by using the Altman Z model. This model states that any company with a score below 1.80 is at the risk of becoming bankrupt. With that in mind, I made an Altman Z calculation for Petrobras.

By looking at the results we can see that the score approached zero on 4Q2015 and will be below 1 for 2016. This implies the company is at risk of becoming bankrupt. I am not saying that the company will certainly go belly up, but this is a measure that helps us understand its poor financial fitness. The only reason I believe the