Gilead Sciences' (NASDAQ:GILD) price makes it a tempting stock to buy, despite a lackluster pipeline and falling sales for its blockbuster hepatitis C drug franchise. The crux of the problem for Gilead is that it is essentially three business combined in one company. It has a steady state HIV treatment business, and shrinking hepatitis C treatment business, and like almost all pharmaceutical companies, an ongoing R&D business. However, the company trades at a price so low investors are able to purchase its HIV franchise and get the rest of the company for free.

Gilead HIV and Hep C Businesses

Gilead's HIV business consists of a multitude of anti-viral drugs that help prolong the life of patients with HIV. Indeed, the drugs are so effective the disease is no longer a death sentence. Gilead benefits from substantial pricing power (the drugs are life-saving) and the fact that patients need to take the drugs daily for the rest of their lives.

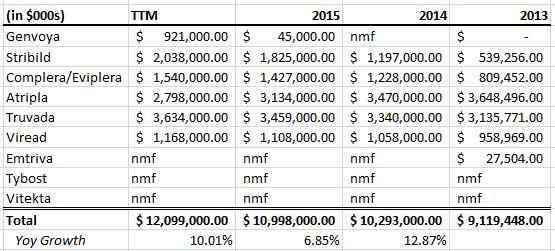

The chart below shows the annual sales of Gilead's major HIV treatments:

We can see that annual growth averages around 9% per year. With patents on many of the major drugs extending out to 2030 we would expect sales to continue to compound at an attractive rate.

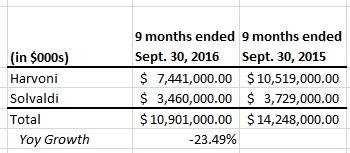

Now contrast this with Gilead's hepatitis C drug sales. After an initial surge in sales from 2014 to 2015 sales have been declining and are likely to continue to decline. The chart below shows the sales for Gilead's two main hep C drugs for the first nine months of their fiscal 2016 year.

The problem for Gilead is three-fold. First, there was an enormous amount of pent up demand for the drug from existing hep C cases. Second, unlike patients with HIV, patients being treated for hep C do not need to take Gilead's drugs for the rest of