Morgan Stanley (NYSE:MS) raised capital today with one billion of fixed to float perpetual preferred stock.

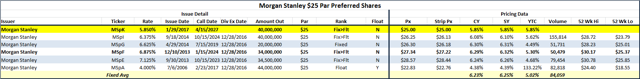

The details of the offering are:

Morgan Stanley has the following ($25 par) preferred stocks outstanding:

Importantly, unlike the Series G, the new issue is a fixed to float structure, which shortens the duration of the issue. I like the new issue, as it is close to par and has the fixed to float structure, unlike many of its peers. From a yield perspective, I like the Series F at a 6.32% stripped yield and seven years until the optional redemption date. The cost for this additional 44 basis points of yield is paying over $2 in premium to par (creating a yield-to-call of 5.30%, which really isn't that bad).

Note that the lowest-priced preferred within the MS complex is the Series A floating rate. The Series floats at 3-month LIBOR + 70 bps with a floor of 4%.

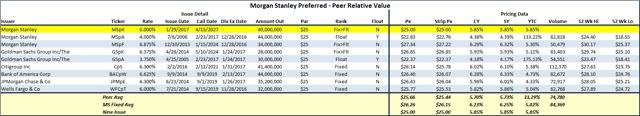

The following table shows the new issue and the Series F versus peers Goldman Sachs (GS), Bank of America (BAC), Citigroup (C), JPMorgan (JPM) and Wells Fargo (WFC).

The yield on the new issue MS is roughly equivalent to many of the peers, with the exception of the BAC Ws, which yield 6.28% for just a little more than $1 over par. Of the above securities, only the Goldman and MS preferreds are fixed to float - which, in my opinion, is a preferable structure.

The Goldman floater - GSpA - floats at 3-month LIBOR + 75 bps and has a 3.75% floor. While it has a 5 bps higher margin, I would take the 25 bp higher floor of the MSpA (and the 20 bp additional yield).

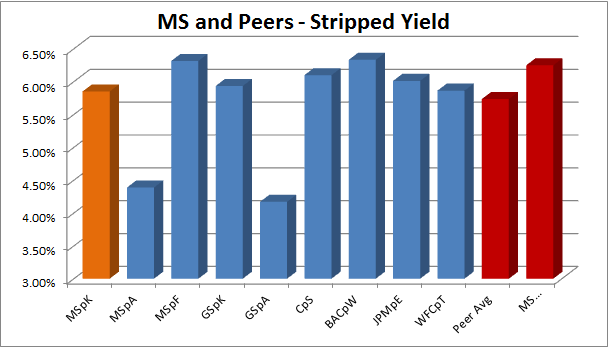

Graphically, the stripped yield looks as below:

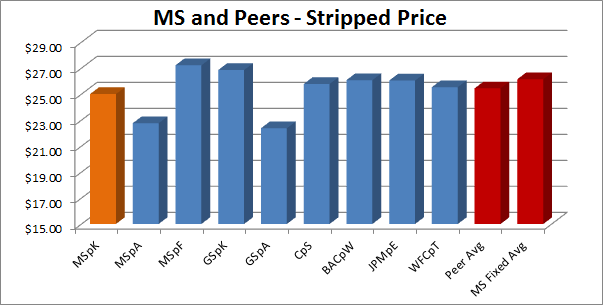

The stripped price:

In order to get a feel for