Gilead Sciences (NASDAQ: NASDAQ:GILD) investors had some reason to celebrate when the biotech company reported fourth quarter and full year earnings on Tuesday. Revenue for the quarter beat consensus estimates by $150 million with $7.32 billion reported. EPS beat by $0.09 with a reported $2.70. The company also boosted the dividend by 10%. But Gilead shares have still dropped over 8% as of Wednesday close because of the weak 2017 guidance that highlighted the company's dependence on its Hepatitis C treatments and the fact that the class of drugs, by design, erodes the potential patient base.

Does the lowered guidance spell doom for Gilead? Not exactly.

(Article slide sources: Company's earnings presentation)

HCV Patient Pools Will Organically, Continually Shrink

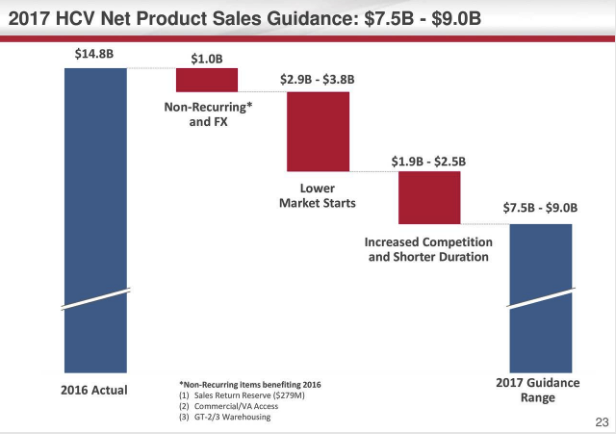

Gilead broke down the reasoning for lowering 2017 guidance by product category, which is just HCV and non-HCV. On the HCV side, the 2017 revenue guidance dropped below this year's reported revenue largely due to an anticipated drop in market starts, which could erode up to $3 billion in sales.

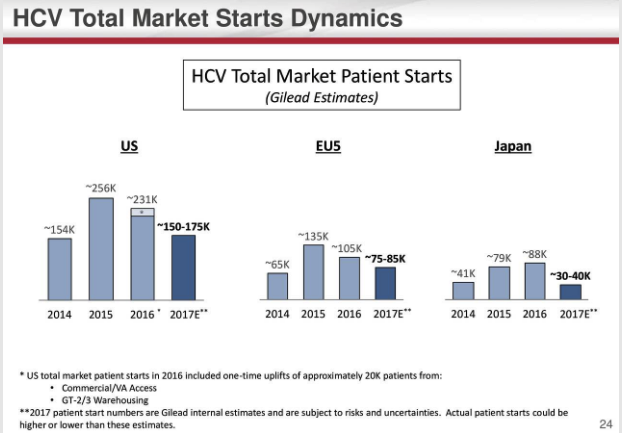

Lower market starts refers to the fact that a decreasing number of patients will need HCV treatment because the existing HCV drugs have high success rates at completely curing the disease relatively quickly. The earlier the disease is caught, the faster the treatment time so Gilead's drugs are going from an entry market rich with later stage HCV patients requiring a 24-week dose or 12-week dose down to a market of early stage patients, who also have the option of postponing treatment for longer, requiring an 8-week dose.

Gilead's staple HCV products saw substantial annual revenue drops compared to the prior year with Harvoni down 34% to $9.1 billion and Sovaldi down 24% to $4 billion. Both drugs saw plummets in the fourth quarter with drops of 51% and 65%, respectively. The drugs are facing rising competition from Merck's