The U.S. Treasury just announced that its auction of $16 billion in a new 5-year Treasury Inflation-Protected Security resulted in a real yield to maturity (after inflation) of -0.049%.

Yes, that is a negative number, and it means that returns for investors in CUSIP 912828X39 will slightly lag inflation over the next five years. Negative real returns for 5-year TIPS have been fairly common over the last six years, but this is still discouraging news for investors hoping to outpace inflation.

The Treasury set the coupon rate for this TIPS at 0.125%, the lowest it will go, and that means buyers at today's auction had to pay a premium for the 0.125% coupon rate. The adjusted price was about $101.00 for $100 of par value, including a small inflation adjustment at the April 28 issue date.

Although bond yields had been rising in the weeks after the November presidential election, they have taken a sharp fall in recent weeks. The Treasury's 5-year real yield estimate hit 0.22% on April 7 and has plummeted since.

Today's auction is evidence that big-money investors are willing to pay dearly for inflation protection. Smaller investors have other options, such as US Series I Savings Bonds and insured bank CDs, both of which could outperform this TIPS.

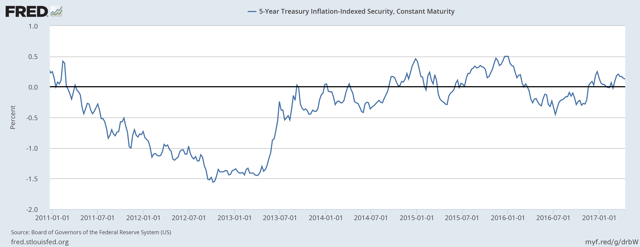

Here's a chart showing 5-year real yields since 2011, when the Federal Reserve began aggressively intervening in the Treasury markets. It shows how real yields had climbed back above zero after the election, only to fall back down in today's auction:

Inflation breakeven rate. With a 5-year nominal Treasury currently trading at 1.77%, this new TIPS gets an inflation breakeven rate of 1.82%, meaning it will outperform a nominal Treasury if inflation is higher than 1.82% over the next five years. That's a little higher than it has been trending recently, indicating stronger