I've been a believer in the future of electric vehicles (EV) since I first strolled into work one morning and caught a glimpse of a bunch of older co-workers all gawking at this brand new luxury sedan.

Tesla Model S

"What in the world is that?" I remember thinking. But once I came to grips with everything, it didn't take me long to establish a long position in Tesla (TSLA) stock way back in early 2013. In hindsight, I liquidated out of my TSLA position way too early, but although explosive gains via that one stock may be long gone for me, luckily, the clean energy/EV movement is only now just getting started.

Call me an ardent bull, but is my own belief that the best gains to be made in the clean energy/EV revolution are still ahead of us. This time around, my vehicle of choice to play the impending paradigm shift is through owning shares of the mining companies that control the clean energy resources (commodities) themselves as opposed to trying to hitch a ride by buying up shares of one of the leading automobile manufacturers.

Anyone who knows anything about mining stocks knows that it's all about the leverage, baby; in an upmarket, that's what you want as a tailwind to turbocharge your gains.

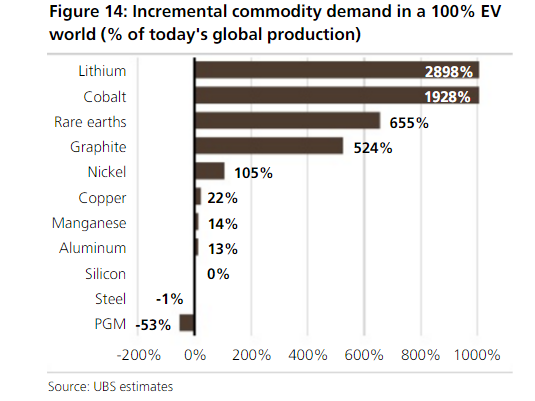

Although there are many materials/minerals/metals that make up your typical lithium-ion battery (the green technology "fuel" of choice today and for the foreseeable future), the consensus 5 to "rule them all" are: lithium, cobalt, graphite, nickel, and copper, as is evident by their projected growth rates (shown below) in what will soon become an increasingly electrified world.

It's quite probable that lots of money will also be made by investors/speculators who get well positioned into the best rare earths, manganese, aluminum, etc. stories as well, but for the