Since 2011, platinum has been a dog in the precious metals sector, and since 2014, that dog has had fleas. With the nickname “rich man’s gold,” platinum has been cheaper than the yellow metal since 2014, and it seems that nobody cares. Industrial users have shunned platinum in favor of another platinum-group metal, palladium. Investors have looked the other way despite the value proposition in the form of the historical price relationships with gold and other metals. Traders and speculators have tossed platinum to the curb in favor of other commodities and assets with more liquidity and less perceived risk.

Platinum is cheap on a historical basis these days, and I am not talking about its price. Prices can be high or low; they cannot on their own be cheap or expensive. The fact is that platinum can claim the title of a cheap commodity, given its historical trading record against other commodities, specifically gold and palladium, over the past four decades.

Platinum has been dropping since 2011, but it has been a dog since 2014

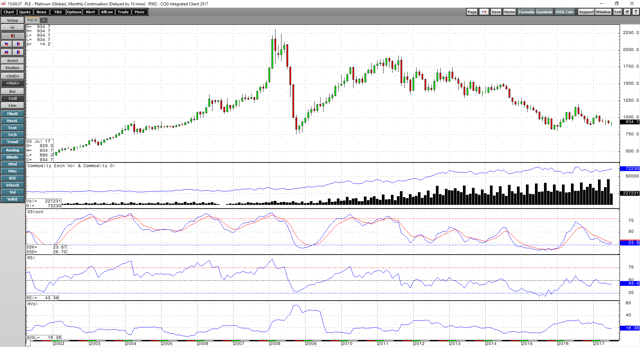

The nominal price of platinum has been in a bear market since 2014.  Source: CQG

Source: CQG

As the monthly chart highlights, the price of platinum has been steadily depreciating since trading at $1,918.50 per ounce in August 2011. By July 2014, the price had dropped to $1,514.30, and that was the last time that platinum traded above the $1,500 level. The rare precious metal fell to $812.20 in January 2016 which was the lowest price since 2008 and less than half the price of the 2011 highs. After a recovery rally that took the price back to a high of $1,199.50 in August 2016, NYMEX platinum futures have moved steadily lower with negative price momentum and rising open interest. In most futures markets, falling price, accompanied by rising open interest, provides a validation of the bearish trend. While the momentum indicator has