It has been a volatile few weeks for the Loonie. Here are my reasons why we could see the Loonie go weaker especially against the Dollar.

1. Breaking down GDP

The growth in the real estate market means that GDP growth has a relatively high weighting towards certain sectors. These include construction, broker dealer fees, real estate rental, etc.

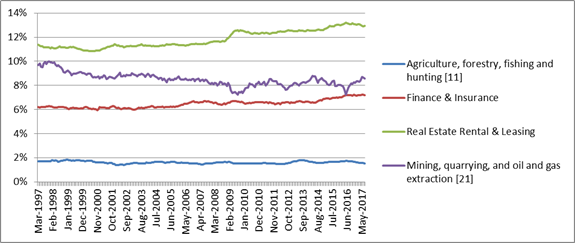

The growth of the "Real Estate Rental & Leasing" sector has been growing from a low 10.83% in July-2000 to 12.92% as per the May-2017. Canadian housing broker commissions as a percentage of GDP has recently reached just below 2%.

Prices following the implementation of foreign tax and China's capital controls have provided drag in the momentum of the property market. Signs of this detrition can be seen in the recent Building Permits which lagged expectations; -5.5% vs. an expected -1.0%

Oil and gas have somewhat stabilized despite the relatively low oil prices, but I do not see it picking up the slack for the weakening fundamentals in the property sector.

I expect the property market to drag on the economy going forward (more on this below), so we are likely to see a further decline in the GDP numbers in the coming prints.

2. Balance of Trade, U.S. impact

Since January, the USD/CAD has declined by over 10%. When you suddenly have a drastically stronger currency vis-à-vis your largest trading partner, basic economics will tell you the balance of demand and supply will be affected.

The higher prices realized by currency moves will result in lower demand for your products while your exports look expensive, making demand drop.

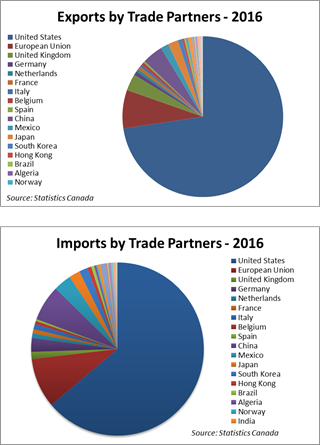

75% of Canadian exports go to the U.S., while 66% of Canadian imports are from the U.S. This balance is also not in favor of Canada, having a declining trade Surplus to the U.S. which looks to weaken