Do you understand why both of the following facts are true? President Reagan cutting the top rate from 70% to 50% was followed by growth improving. The 1986 tax reform act that lowered the top rate to 28% launched the weakest 30 year period since the Great Depression. If your view of tax policy doesn’t explain both these facts, you may want to consider one that does.

A Low Top Tax Rate Hurts Growth

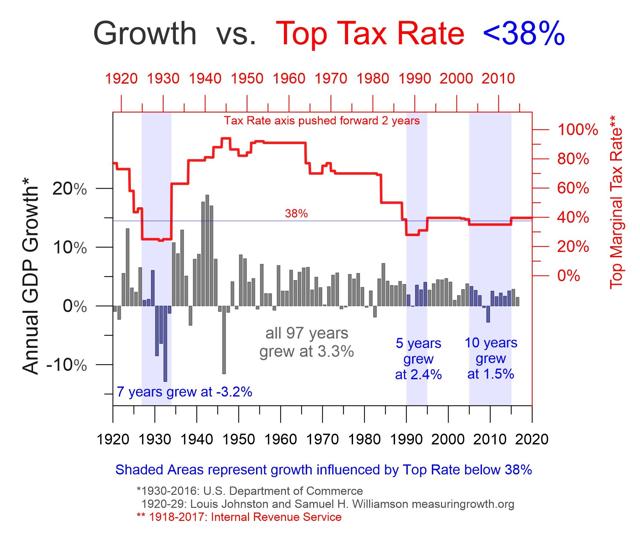

Let’s clear up the common misconception that a low top marginal tax rate encourages growth. While pundits and ideologues can cherry pick periods to claim anything they want. The last 100 years in the US has no support for the idea of a low top rate encouraging growth.

The 22 years the top tax rate was below 38 percent had an average growth of 1.5 percent. History suggests the top tax rate one year has its biggest influence on growth two years later. So, the top rate of 35 percent in place from 2003 through 2012 would have influenced growth for the years 2005 through 2014. Those 10 years grew at a 1.5 percent pace. Using this two-year lead time the 22 years influenced by the low top rates averaged 0.3 percent growth. A low top rate has no success stories in the U.S. in the last century.

Two Requirements for Prosperity

Widespread sustainable prosperity requires two features from income tax policy. We can think of these as two pockets. The taxable income drawn from the business is the small pocket. The big pocket is the value of the business. Business owners must be able to draw out of their businesses a large enough income at a low enough average tax rate that our wealthy and talented have sufficient incentive to run businesses. This is the small pocket incentive, and it must