Introduction

Natural gas is beginning to come into its own as a preferred fuel. Clean energy mandates globally have de-linked it from a traditional cost association with coal as a power generator. A similar de-linkage with diesel is also happening for the use of LNG/CNG as a transportation fuel. The driver of reduced emissions and lowering the carbon footprint is very compelling for this fuel and one super-major oil company, Shell, has made a strategic decision to align itself with LNG. It's creation of a separate subsidiary, Integrated Gas will propel it ahead of its competition in these markets.

In this article, the second of a two parter on Shell, I will discuss the company's transformation into the global LNG powerhouse it has now become. My thesis is that when all of this is added up, Shell will outperform in years to come.

The Transformation

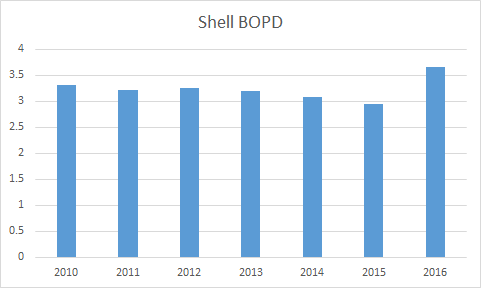

A few years back, Shell was a company struggling to find it's footing. Exploration success had plateaued, and daily liquids production was suffering. From the graph below you can see that the lack of success in exploration was starting to equate to reduced production.

Source: Shell annual reports; chart by The Fluidsdoc.

Then in 2014, Ben Van Beurden was elevated to the CEO spot and the company began a strategic shift toward gas and gas liquids for this oil giant. In 2015 the acquisition of BG group was announced. Shell was criticized for this merger initially, mainly on cost. At almost $70 bn it saddled Shell with massive debt at a time when it looked like there was just no bottom for oil. The stock price reflected in the five year chart below highlights the concerns investors had about the company's future in the 2015/6 time frame.

Paired with an aggressive $30bn asset