Source: imgflip

Recently, I've been pounding the table about just how mispriced midstream MLPs are right now. This includes some of the highest-quality low-risk names in the industry, including Enterprise Products Partners (EPD), MPLX (MPLX), and Enbridge Inc. (ENB).

AMLP Total Return Price data by YCharts

AMLP Total Return Price data by YCharts

I've explained how the industry's steady slide over the last few months makes absolutely no sense, given the strong fundamentals of the industry as a whole, but especially since each of these stocks have rock-solid balance sheets, highly secure and growing payouts, and excellent long-term growth prospects.

Well, the list of Grade A, low-risk and fast-growing MLPs is long, and so I feel the need to point out two more industry blue chips that make excellent long-term, high-yield income growth investments right now.

Let's take a look at why Magellan Midstream Partners (MMP) and Spectra Energy Partners (SEP) are two of the best ways for conservative high-yield investors (including those nearing retirement looking to live off dividends) to add to their diversified high-yield portfolios today.

Magellan Midstream Partners: Industry's Most Profitable SWAN Stock

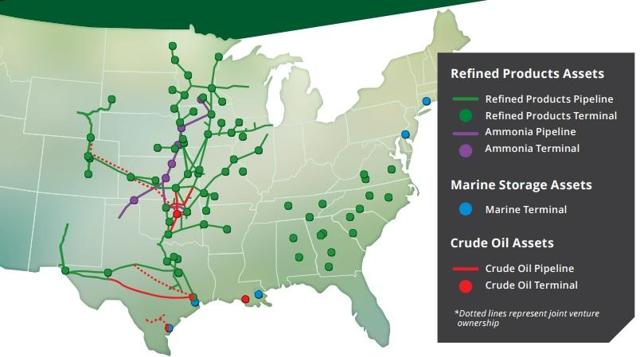

Magellan Midstream owns America's largest refined product pipeline system, with 9,700 miles of pipelines, 53 refined product storage terminals with 42 million barrels of storage capacity serving 15 states.

Basically, Magellan's vertically integrated infrastructure connects oil producers, to oil refiners, and refiners to gas stations.

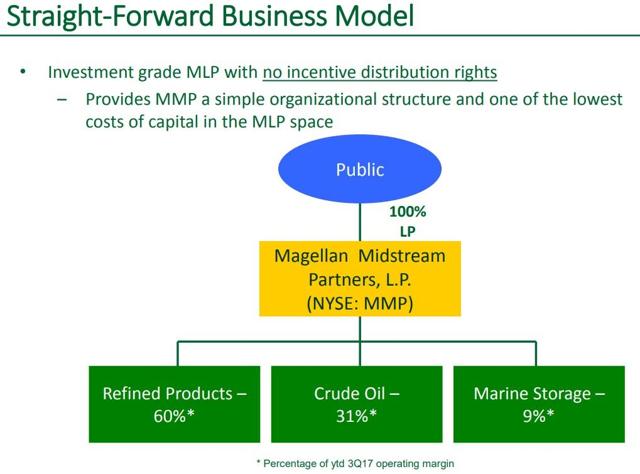

Source: Magellan Midstream Partners investor presentation

Source: Magellan Midstream Partners investor presentation

In addition, the MLP owns:

- 2,200 miles of crude pipelines and 27 million barrels worth of storage facilities.

- 5 marine storage import/export facilities with 26 million barrels of capacity

Source: Magellan Midstream Partners Investor Presentation

The vast majority of operating margins are derived from the refined product segment because of the highly profitable nature of this business.

Specifically, most of Magellan's system is located in the middle of the country, where