The Health Of The Consumer

Each month, the Bureau of Economic Analysis releases the report on Personal Income and Outlays. This is one of the most important and detailed reports that come out each month as it contains personal consumption expenditures, which represents ~70% of total GDP, as well as income levels, savings rates, and inflation.

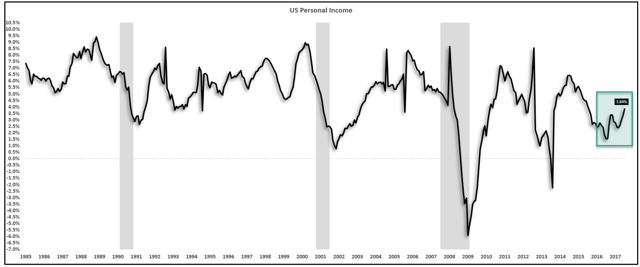

Personal Income, the broadest measure of income, increased to 3.84% year-over-year growth, up from 3.37% last month and 1.51% one year ago. Total personal income includes wages and salaries, interest collected, government transfer payments (entitlements), and all other sources of income.

There has been a fairly material acceleration in Personal Income growth, highlighted by the green box. The growth, however, is largely attributed to inflation. The figures on real personal income growth (inflation adjusted) are not quite as promising.

Total Personal Income Growth:

Inflation rose for most of 2017. Inflation is being pulled higher by energy prices because the rate of growth in core PCE (inflation ex. energy and food) is still muted.

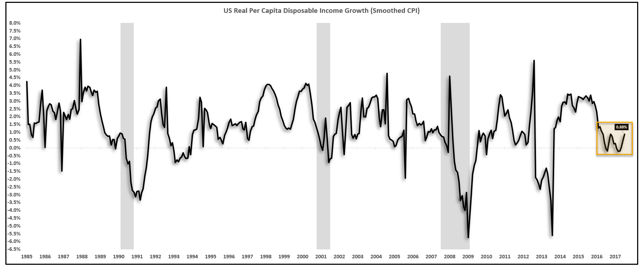

Disposable personal income is equal to total personal income minus personal taxes. Real disposable personal income growth (inflation adjusted) only increased to 0.88%.

After taxes and inflation, the total income in the economy is up 0.88% per capita from one year ago.

Real Per Capita Disposable Income Growth:

You can see how the rise in 2017 is considerably less in the inflation-adjusted chart compared to the first nominal chart.

Core PCE (inflation) remains muted at 1.48%, still well below the target for the Federal Reserve. If the Federal Reserve continues to raise rates with inflation so depressed, the yield curve should continue to flatten. Long-term interest rates will not rise without a material rise in inflation. Long-term bonds (TLT) should continue to perform well in 2018.

Core

EPB Macro Research is my premium service on Seeking Alpha. EPB Macro Research provides no-spin, unbiased and in-depth macroeconomic analysis that is used to forecast markets and generate a portfolio based on which asset class is likely to outperform over the next 1-2 years. Most economic analysis is biased, unreliable and unaccountable. EPB Macro Research is fully transparent, providing a full track record of all the changes to the model portfolio. I have a free trial open until December 31, 2017. Join EPB Macro Research for free and see how in-depth, consistent and evidence-based macroeconomic forecasting can be added to your personal investment process. Click Here for more information about EPB Macro Research. Act now before the free trial expires!