A Look Back

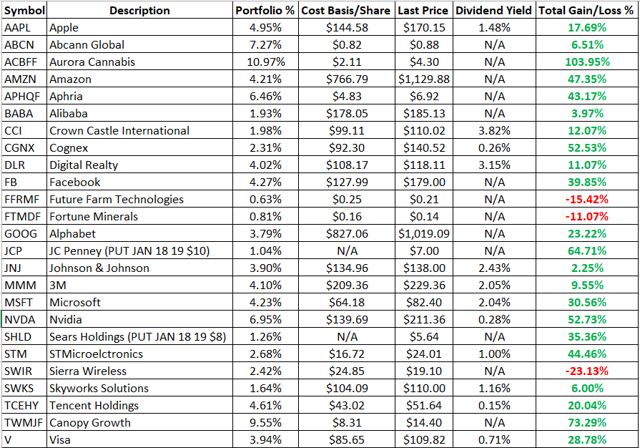

I began my series of articles covering my own personal investing endeavors with my article, "The BAK Portfolio: Making Money On Cannabis And Tech." The portfolio was started in March 2017 with the goal of capitalizing on a number of emerging industries/technologies, namely the nascent Canadian cannabis industry and the global move to cloud computing and AI, as well as the 5th generation mobile networks. At the time of my previous article, the portfolio stood as thus:

Additions To The Portfolio

I decided to increase my exposure to the cannabis industry by adding positions in two companies: Namaste Technologies (NXTTF) and Cannabis Wheaton (OTCQB:CBWTF).

Namaste Technologies is the largest purveyor of cannabis vaporizers in the world, operating in 26 countries. The company has recently announced a number of supply agreements with some of the largest cannabis producers in Canada and Israel. I firmly believe that vaporizing will replace smoking as the preferred method of consuming cannabis, so I expect Namaste to benefit greatly from this tailwind.

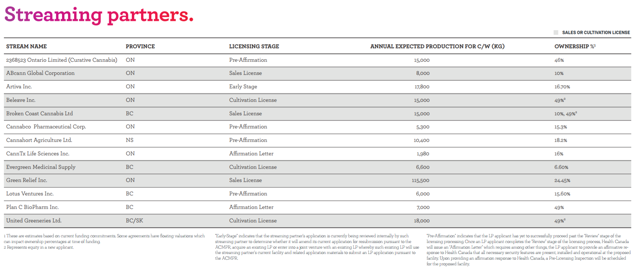

Cannabis Wheaton is primarily an investor in other cannabis companies. The company borrowed a financing method common in the mining industry: streaming. Basically, streaming is where investor provides funding for another company and in return the investor gets a share of the products produced. In Cannabis Wheaton's case, this takes the form of providing funds for growing space expansion, with the company taking a share of the revenue generated by the cannabis grown on the added space. The company is partnering with a number of up and coming cannabis companies, including one I own, ABcann Global (ABCCF):

Source: Cannabis Wheaton Investor Presentation

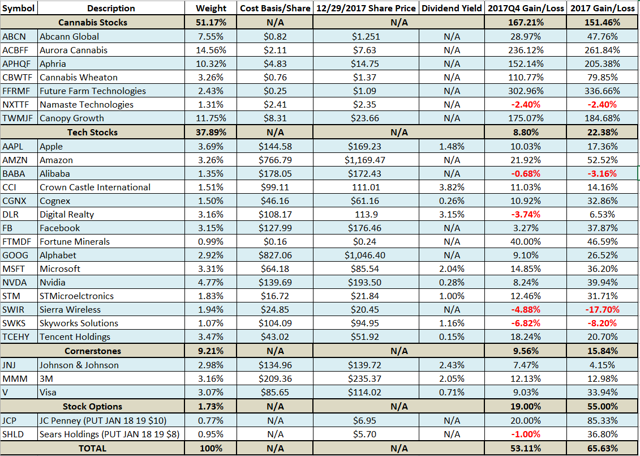

The BAK Portfolio At The End Of 2017:

Cannabis Stocks Are Burning Bright

Q4 2017 was a personal best for me, by a long shot, with an ROI of 53.11%. After the