Shares of Gilead Sciences (NASDAQ:GILD) have underperformed the iShares Nasdaq Biotechnology ETF (NASDAQ:IBB), which tracks the total return performance of the Nasdaq Biotechnology Index (NASDAQ:NBI), up only 2.96% in 2017, compared to a 21.08% gain for the IBB, on concerns about their declining hepatitis C, or HCV, product sales and fierce competition from GlaxoSmithKline (NYSE:GSK) in the HIV drug business. Despite analysts and investors pressuring Gilead executives about M&A since early 2016, the company finally decided in August 2017 to acquire Kite Pharma, Inc. for $11.9 billion, or $180.00 per share, in cash.

Kite's CAR-T cell immunotherapy Yescarta (axicabtagene ciloleucel), which received FDA approval in October 2017 for the treatment of patients with relapsed or refractory large B-cell lymphoma, is priced at $373,000 and expected to pull in $90 million in 2018, according to Brian Abrahams, analyst at RBC Capital Markets. The analyst is expecting Yescarta sales to grow to $1 billion by 2026 and a peak revenue potential of $2.7 billion.

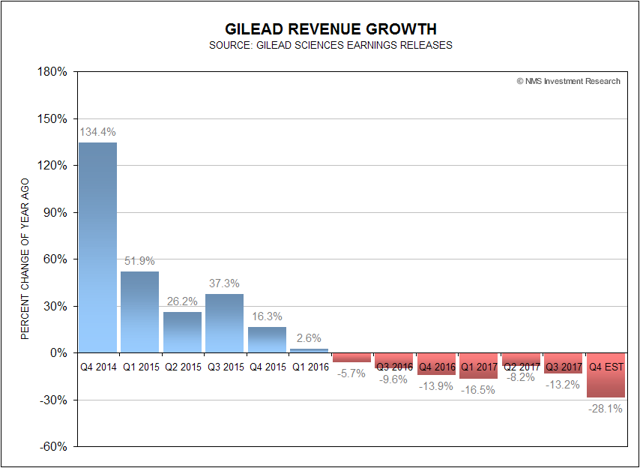

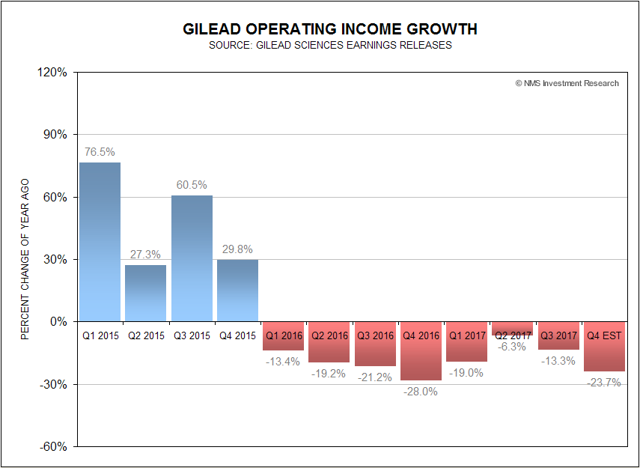

Gilead reported Q3 2017 revenues and earnings that exceeded analysts' expectations but gave weak HCV product sales guidance for 2017. Wall Street might be overly bearish though, as Gilead raised the lower end of their full-year, or FY, 2017 net product sales guidance to a range between $24.5 billion and $25.5 billion, from the previous guidance of between $24.0 billion and $25.5 billion. The company also raised both the top and lower end of their FY 2017 non-HCV product sales guidance by $500 million to a new range between $16.0 billion and $16.5 billion, but cut the top end of the FY 2017 HCV product sales guidance by $500 million to a new range between $8.5 billion and $9.0 billion.

Based upon the new guidance, Wall Street is now expecting Gilead's Q4 2017 revenues to come in at $5.26 billion, at