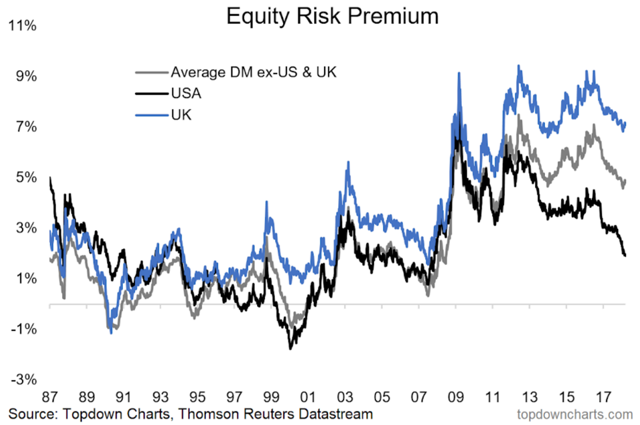

This week the "Chart of the Week" shows the equity risk premium across a couple of key developed economy stockmarkets. The equity risk premium provides a unique perspective on valuation, which brings in not just what's going on with absolute valuations, but also reflects the opportunity cost or trade-off vs less risky assets. This makes it of particular interest to asset allocators.

The chart in particular shows the equity risk premium [ERP] for the UK, as compared to the US and the rest of DM (developed markets), and comes from a

report on the contrarian case for UK equities

. The main conclusion is, that solely on an ERP basis the UK is among the most attractively valued DM equity markets. While it is only one factor, the 500 basis point spread vs the US ERP is certainly something to talk about.There are dozens of ways to calculate the equity risk premium, and in this case the formula I have used is ERP = (1/PE10) - (10yr Gov't Bond Yield - 10yr CPI CAGR). In other words, the earnings yield using 10-year average earnings minus the real yield where the real yield is the 10-year government bond yield minus the 10-year inflation rate (10-year rolling CPI compound annual growth rate). I have used the government bond yield of the domestic market, so for the UK market it is the 10-year yield on gilts.

Aside from the relative value case for the UK, it's also interesting to note how much the US ERP has come down - both as a result of more expensive equity market valuations, and steadily higher bond yields. While the US ERP is slightly below average, it is still comfortably higher than either the 2007 top or the particularly extreme case of 2000. And though it is higher than these previous major tops, it