As pass-through entities, REITs avoid the double taxation that afflicts most C-Corps where the business is taxed and then the investor is taxed on the distributions received from the business. As a partial counterbalance to this favorable treatment, standard REIT dividends are not taxed at the dividend tax rate, but instead at the ordinary income rate. For many people, the dividend tax rate is significantly lower than the ordinary income tax rate. This has led conventional wisdom to conclude that REITs should be held in IRAs or other tax sheltered accounts rather than taxable investment accounts. In this article, I intend to challenge this conventional wisdom by detailing the advantages of REITs in a taxable account.

Taxation of REIT dividends

My personal taxable investment account is filled with REITs. Historically, there has been an occasional non-REIT, but the overwhelming majority of the holdings have been REITs. This is partially due to REITs being my area of expertise, but there are also numerous tax benefits to holding them in a taxable account, which I think are often overlooked or even not known by most investors.

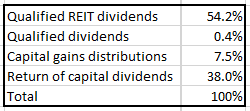

To illustrate the taxation of REIT dividends, I will use data from my form 1099 for tax year 2017 which details my dividend receipts falling into the following characterizations.

Data from E-Trade 1099 for my personal margin account

Different REITs give different dividend characterizations, and it can vary within a REIT between different tax years. These percentages are somewhat representative of the REIT universe as they came from a diversified REIT portfolio, but experiences can vary widely for individual REITs.

Qualified REIT dividends are not the same as qualified dividends and are for tax purposes considered to be not qualified. This means that qualified REIT dividends are taxed at the ordinary income rate.

Qualified dividends are taxed at the dividend income rate, but in my portfolio, this was a meaningless portion of the pie coming in at 0.4%. I suspect a very low percentage of dividends being qualified will be typical for most REITs.

Capital gains distributions often result from REITs profitably selling properties and passing along those profits to shareholders. These are taxed at the long-term capital gains tax rate which is usually quite a bit lower than ordinary income.

Finally, we have the return of capital dividends which is tax deferred. Rather than incurring tax as the dividend is received, one's cost basis in the security is lowered by the amount of the dividend. Therefore, the taxes associated with these dividends are deferred until the security is sold. Furthermore, they will be taxed at the favorable long-term capital gains rate upon sale provided that the security was held for at least a year.

Now that we have the breakdown of how taxes can actually play out in a diversified REIT portfolio, we can begin the process of assessing whether or not REITs are beneficial in a taxable account.

The barrier

The barrier to REITs being advantageous in a taxable account is precisely the source of the conventional wisdom; the fact that the qualified REIT dividends are taxed at the ordinary income rate. Far too often I see this stated as a blanket statement with implications that it is true of all REIT dividends.

On the contrary, only 54.2% of my 2017 REIT dividends were taxable in this fashion. The remaining dividends are far more favorable.

Benefits

7.5% of my dividends were characterized as long-term capital gains and are taxed at the associated lower rate. The big advantage, however, is the 38% chunk that is tax deferred. With the ability to defer taxation for an undefined period at my option, it allows more capital to stay invested, earning a return.

Starting in tax year 2018, an additional benefit has been added to REITs, thanks to tax reform. The 54.2% of my dividends that are qualified REIT dividends will now be 20% deductible. This means that starting in 2018 all three major forms of REIT dividend characterizations are favorable in some way.

Qualified REIT dividends are 20% deductible against earned income. Capital gains dividends are taxed at the lower long-term capital gains rate. Return of capital dividends are tax deferred and upon sale taxed at the capital gains rate.

Overall, I think REIT dividends are reasonably tax friendly, and this is stacked on top of the massive benefit of the REITs themselves foregoing taxation on their income.

No double taxation

Since the REITs do not have to pay taxes at the corporate level (provided they pass through 90% of income as dividends to shareholders), more of their cash flows can by reinvested in growing the company. This has important strategic implications. For any given asset (Asset X), if it is deemed by the IRS to be REITable, it is more profitable for a REIT to own that asset than for a C-Corp to own that asset. In other words, a REIT will generate a higher after-tax ROIC buying Asset X than a C-Corp would in buying the same asset.

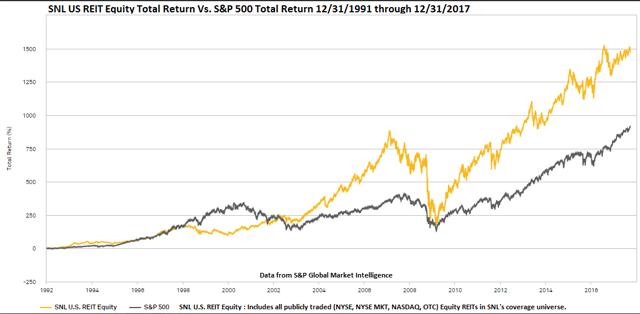

This is a sizable strategic advantage, and through dividends and growth, the advantage eventually translates to higher returns for shareholders. In my opinion, the tax benefits are the primary reason REITs have materially outperformed the broader market over a long stretch of time.

With REITs trading down over the last year, they may not feel like good investment vehicles, but this downtrend is unusual relative to the historic outperformance. I consider the price declines to be an opportunistic entry point and have a bullish outlook on REITs relative to the S&P.

Disclosure: 2nd Market Capital Advisory Corporation does not provide tax advice. The material contained herein is for informational purposes only and is not intended to replace the advice of a qualified tax advisor. Investors should consult with their own tax advisor or attorney with regard to their personal tax situation. This article is provided for informational purposes only. It is not a recommendation to buy or s ell any security and is strictly the opinion of the writer. Information contained in this article is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions. Dane Bowler is an investment advisor representative of 2MCAC, a Wisconsin registered investment advisor. Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts and findings in this article. Positive comments made by others should not be construed as an endorsement of the writer's abilities as an investment advisor representative.