Investment Thesis

Micron Technology (NASDAQ:MU) continues its sell-off following last month's quarterly earnings. The irony is that Micron's results were not bad. And further compounding this irony is that its valuation is presently so cheap - selling at these prices makes little sense.

Recent Results

Micron ended Q2 2018 with a remarkable increase in revenue, up 58%. This increase in revenue percolated all the way through the company, with Micron's scale providing it with strong operational leverage that ultimately translated into solid free cash flow of $2.2 billion. However, the market became concerned that Micron is increasing its capex by too much, and investors are still unsure whether this lumpy increase in capex will actually pay off.

In the past, Micron has had periods of elevated capex, and these capital investments have not always paid off. Investors are understandably concerned that this could be the case again for Micron. However, presently, as of Q2 2018, Micron's balance sheet was particularly strong, with net debt of only approximately $1.5 billion, which is not a lot considering that Micron generated $2.2 billion of free cash flow in a single quarter. Overall, Micron's balance sheet offers the company plenty of room to execute on its ambition to develop its high-performance DRAM memory for hyper-scale datacenters and cloud computing.

Valuation

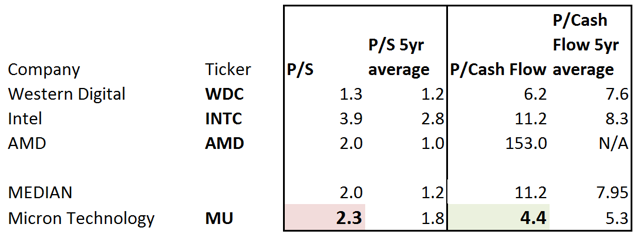

Looking at the above table we can immediately see, how the peer group's P/Sales ratio is being priced. I should note to readers that have not read my work before that I'm a big fan of the P/Sales ratio as there is a lot of research showing that this ratio is 'reflective' of investors' sentiment towards a stock. I'm also a fan of the P/Sales ratio because it is less volatile than P/E or other metrics. Thus, we can see how the peer group's P/Sales ratio went from 1.2X to 2X. In fact, every