Tesla's (NASDAQ:TSLA) Q2 results affair was an interesting one to say the least. The shareholder letter and the earnings call were masterfully done to accentuate the positive and to minimize or avoid the negative. Thanks to the choreography and the willingness of the bulls to believe CEO Elon Musk’s narrative despite past track record, the stock climbed up about 15% since then.

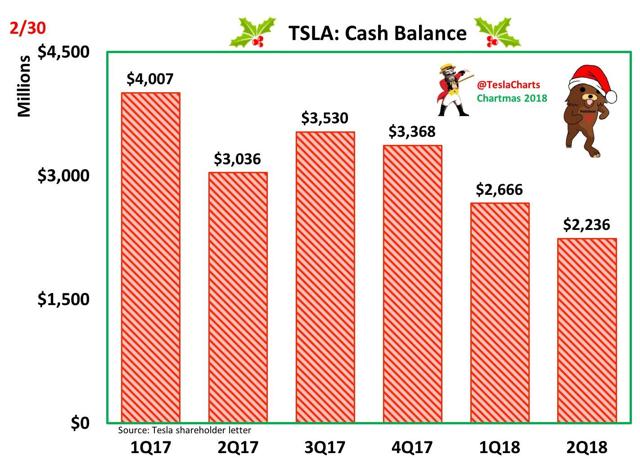

Tesla posted record losses worse than consensus, but on the biggest issue that was in focus, cash, the company showed a higher balance than expected. While the company’s cash balance declined (image below from Twitter user @TeslaCharts), at over $2B, there is no imminent risk of bankruptcy.

How has the company been able to keep the cash balance from deteriorating significantly in the face of a record $700M+ loss?

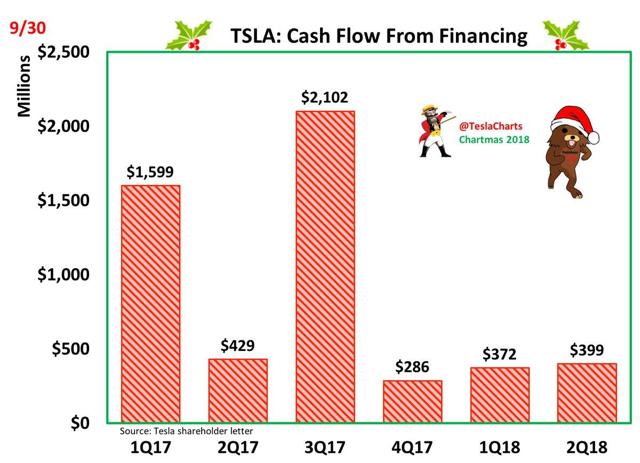

By stretching the working capital (image below) and by tapping into ABL and other financing (image below).

So, how does this situation change in Q3?

Assuming Tesla hits the guidance of 50K to 55K units for Model 3, at 15% margins, cash flow can improve by about $300M. In addition, stock option exercises at Tesla have accelerated and will likely accelerate further due to layoffs, attrition, and concerns about Tesla. These options exercises may add several tens of millions of cash to Tesla's balance sheet. Also, note that Tesla has not sold any ZEV credits in Q2 and could raise as much as $200-$300M in cash from the sale of ZEV credits in Q3.

All else being equal, between the above three items, Tesla will be able to largely stem the negative cash flow in Q3.

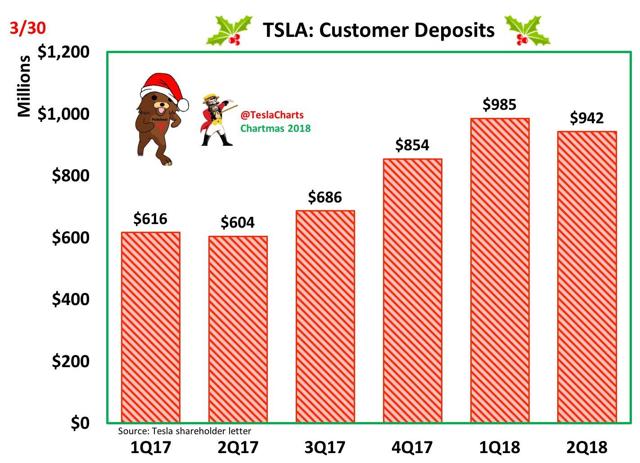

However, all else is not equal. An important factor that is keeping the Tesla cash story together is the “customer deposit” line item (image below).

We already know that Tesla customer cancellations are

Subscribers to Beyond The Hype have access to all the linked articles that may otherwise be inaccessible. For timely, cutting-edge insights, analysis and investing ideas of solar, battery, autonomous vehicles, and other emerging technology stocks, check out Beyond the Hype. This Marketplace service gives you early access to my best investing ideas, along with event driven and arbitrage opportunities when they are most edgy and actionable. If you want expert advice on seeing through the hype, separating fact from fiction, avoiding investing landmines in emerging technologies, and an opportunity to participate in a vibrant and intellectually stimulating real-time chat room with other high-caliber, like-minded investors, consider subscribing to Beyond the Hype today. Subscribers also get access to all past articles.