I have enough money to last me the rest of my life, unless I buy something.” ― Jackie Mason

Today, we take our first look at a small ‘Tier 4’ biotech concern that has only been on the market for nine months.

Company Overview:

Spero Therapeutics, Inc. (NASDAQ:SPRO) is a Cambridge, Massachusetts based early clinical-stage biopharmaceutical company focused on developing treatments for multidrug resistant (NYSE:MDR) bacterial infections. The company was formed in 2013 and currently carries a market cap of ~$200 million. Spero came public in November 2017, netting $74.4 million at $14 per share. In early July, Spero raised ~$75 million in a secondary offering of preferred shares and common stock. The common was priced at $12.50 a share.

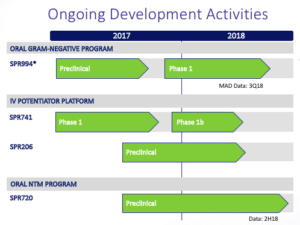

Pipeline:

SPR994. Spero’s most advanced candidate is SPR994, which the company hopes will be the first broad-spectrum oral carbapenem-class antibiotic for use in adults to treat MDR Gram-negative infections. The treatment is an oral form of tebipenem, an antibiotic marketed as Orapenem since 2009 by Meiji Seika Pharma Co. Ltd. (Tokyo: 2269) in Japan, where it is used to treat common pediatric infections including pneumonia, otitis media, and sinusitis. Since it is already on the market, there is plenty of research available on tebipenem, including a 3,500 patient post-approval study in Japan.

The increasing prevalence of drug resistance and MDR Gram-negative bacteria, as well as the limitations of existing therapies demonstrate the need for new novel antibiotics. Carbapenems have been utilized for over 30 years and are considered the standard of care for many serious MDR Gram-negative bacterial infections but are currently only available through two hour IV administrations three times a day. With that said, It should be noted that Achaogen, Inc’s (NASDAQ:AKAO) once daily 30-minute IV administration antibiotic (Zemdri) just received approval from the FDA for complicated