On Friday morning, the August jobs report was accompanied by a much hotter-than-expected average hourly earnings print.

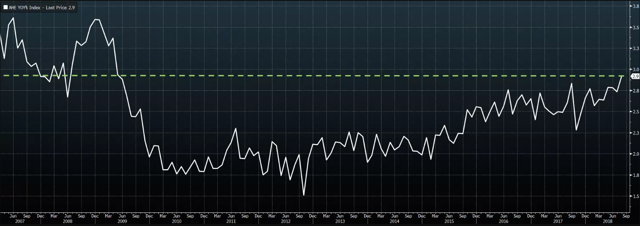

Specifically, the MoM change was 0.4%, double consensus and the YoY rate hit 2.9%, beating the estimates of all economists surveyed by Bloomberg and marking the briskest pace of wage gains since 2009.

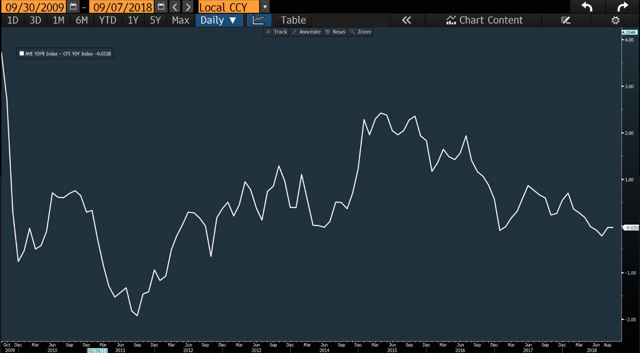

Before I go any further, let me just address the elephant in the room here. Real wage growth is negative. Although we'll have to wait on the August CPI data for the "official" read on this situation, extrapolating gets you real wage growth of -0.03%:

(Bloomberg, h/t Michael Regan)

(Bloomberg, h/t Michael Regan)

Ok, so after the data hit on Friday morning, I took my readers on a trip down memory lane to Friday, February 2, the last time the market was taken off guard by a well-above-consensus AHE print. That was the fateful Friday that presaged a week during which the VIX staged its largest one-day spike in history and the Dow (DIA) fell more than a 1,000 points on two separate occasions.

Less than two hours after the February 2 jobs report hit, I warned readers on this platform that things were likely to go sour in a hurry in a post called "Make Good News Bad Again: Jobs Report Heightens Fear Of Vicious Bond Bear". Just to drive home the point, here is the bullet-pointed summary from that article:

Well, Friday's jobs number was both good and bad - but mostly bad if you're an equity bull.

Everyone was laser-focused on the AHE print and it beat in a big way.

Now the question is whether the ongoing bond rout will further undermine the stock market rally.

Again, that was published at 10:10 AM on Friday, February 2. The Dow fell more than 660 points that day and the following Monday, suffered