Bayer (OTCPK:BAYRY) reached an all-time high in March 2015 reaching 137 EUR per share. Since then, the price has almost been halved. The company is currently trading at 73.49 EUR. In the US it can be purchased on the OTC market under the ticker BAYRY for 21.17 USD.

There are several key reasons for this drop, but I believe it’s overdone. Long term, Bayer looks like an attractive investment.

Now, why did it drop by this much?

The first reason is sluggish top line growth. You can read more about this in the next section.

The second reason is the Monsanto takeover it did last year, the biggest all-cash deal ever at $66 billion. The company just issued $30 billion in bonds and equity to finance the deal. Bayer had to sell parts of the business to comply with competition regulators, and this yielded another $9 billion, mostly because of asset sales to competitor BASF (OTCQX:BASFY).

A short introduction

Let’s start by investigating how Bayer got to the all-time high of 137 EUR in the first place.

Since 2011, the company has been able to grow top line and bottom line quite consistently.

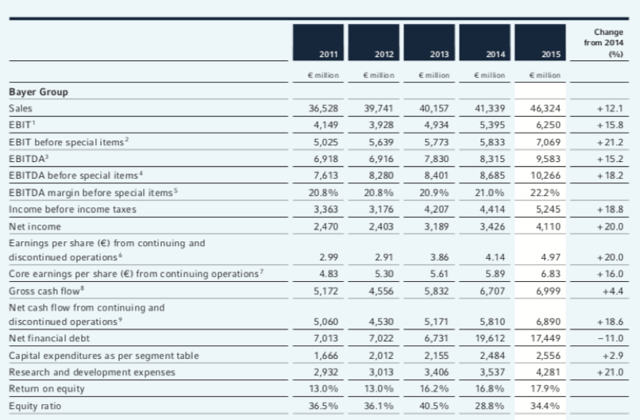

Source: Bayer’s 2015 annual report

In 5 years' time, sales rose by 27%. More impressively, net income increased by 66% over the same period. The return on equity was 17.9% in 2015. In the meantime, net financial debt increased as well, reaching $17.5 billion in 2015.

All-in-all, it seemed like the company was doing great. Earnings were up, cash flow was up, RoE was up. The company also invested heavily in R&D, allocating $4.28 billion in 2015. This is vital to Bayer, which sells a lot of pharmaceuticals, as you'll learn later on.

Fast forward to today, and here comes the bad news.

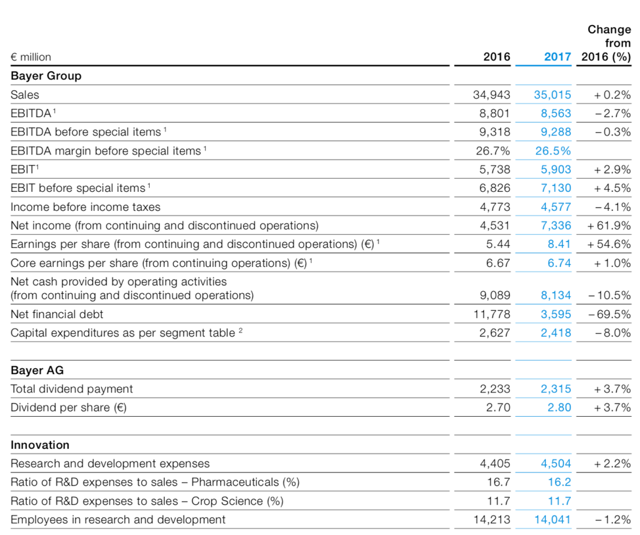

Source: Bayer’s 2017 annual