I've long contended that when it comes to the trade war, Chinese authorities aren't as concerned about the domestic stock market as the U.S. administration would have the American public believe.

On multiple occasions over the past several months, President Trump has referenced the disparity between the performance of U.S. stocks (SPY) and Chinese equities as evidence that America is prevailing in the ongoing trade dispute. For instance, at a rally in Ohio early last month, Trump said this:

Sadly, because I don't like this, the Chinese market is down 27% in the last three or four months.

Since then, he's repeated that (or some derivation thereof) on Twitter. Last Thursday, for example, he said this:

We are under no pressure to make a deal with China, they are under pressure to make a deal with us. Our markets are surging, theirs are collapsing.

That is probably not the correct way to think about things and indeed, it's not consistent with the way the administration itself has generally defined "winning" and "losing" on trade.

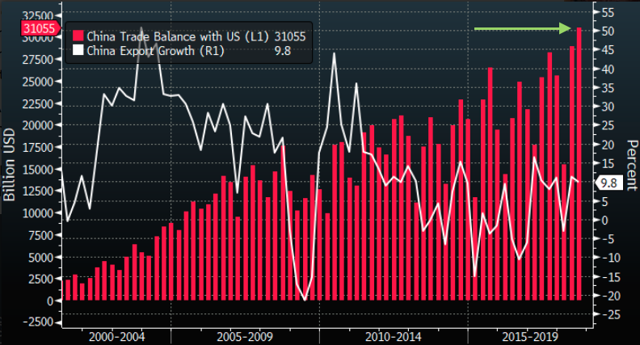

Economists will tell you that nobody "wins" in a trade war and they'll also tell you that thinking about deficits and surpluses in terms of "winning" and "losing" is to misunderstand deficits and surpluses. But let's give the President the benefit of the doubt and assume there's some validity to the notion that "winning" and "losing" can be defined in terms of trade balances. If that's the case, the U.S. isn't "winning". In fact, China logged the largest surplus on record with the U.S. in August:

On top of that, the rapid depreciation of the Chinese yuan (CYB) that started in late June after the PBoC decided not to raise rates in open market operations following the Fed hike (on the way to enacting a