Investment Thesis

Microsoft (NASDAQ:MSFT) has been a terrific investment in the past 3 years. But what about going forward? In this piece, I argue that going forward, over the next 2-3 years, Microsoft continues to have a strong opportunity ahead but that investors are not fully pricing in Microsoft - at least not quite yet.

Recent Developments

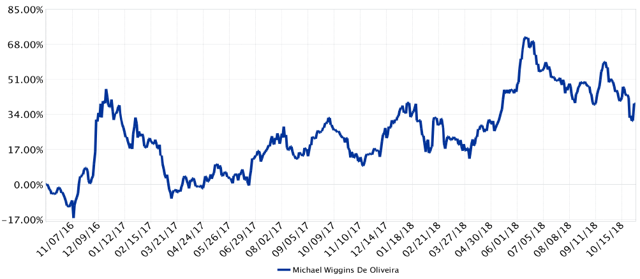

Back in May 2017, I wrote an article titled, Microsoft's Future Growth Will Come From Azure, Investors Are Missing This Opportunity. In that article, I took a bullish stand, as its title describes, that Azure would enable Microsoft to deliver strong returns for its shareholders.

Now, looking over 2018, Microsoft is one the few tech names which ended 2018 with strong appreciation - which is all good and well for long time shareholders, but what about the opportunity going forward into 2019 and further ahead? How does that stack up?

Today, I argue that over the next 2-3 years, Microsoft will continue to deliver strong results. And while analysts typically look at the recent past and have a strong tendency to extrapolate this long into the future, which I could be perceived of also doing, I stubbornly assure you that this is not the case. Here is why.

The Cloud Challenge

The cloud environment has now started to become largely commoditized. Some companies describe to their investors their cloud platforms, which are really just enhanced servers, as a way of getting a large multiple on their share prices - to be seen to be participating in this hot space.

Others, such as Alphabet (GOOG) (GOOGL), actually do have strong cloud offerings, but only control a small amount of market share. And although I'm very bullish Alphabet, I'll be the first to point out that Alphabet's cloud prospects are not

Find alpha in unloved names with enormous upside potential!

At Deep Value Returns, I'm laser-focused on two things: free cash flow and unloved businesses. Companies going through troubled times, but that are otherwise stable and cash flow generative when bought cheaply, provide investors with an opportunity for exceptional returns once those names come back in favor. If you're looking for a deep value investing approach inspired by Buffett, Icahn, and Greenblatt that can help you generate between 50% and 200% potential upside in just a few years, then sign up for your two-week free trial with Deep Value Returns today!