In a recent article, I looked at the typical defensive sectors to see how they held up in the recent volatility. Here's The Defensive Utilities, Pipes and Telco's Start To Do Their Thing, Again.

While it was not a major market test, the defensive sectors started to perform as we would hope or expect in market corrections - they started to hold up much better than the broad market. In this article, we'll look at the sectors that held up the best in the last two recessions as outlined in The Lowest Volatility Sectors For Retirees.

We'll use the Consumer Staples (XLP), Consumer Discretionary (XLY) and Healthcare (XLV) sectors as the clear winners and add Utilities (XLU) that held up reasonably well in the last two recessions, but is known for its generous income and defensive nature.

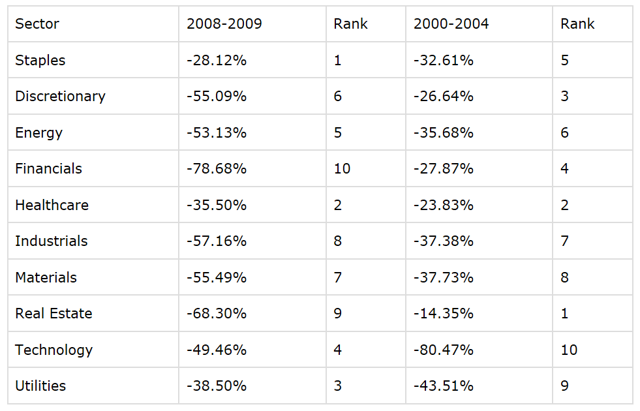

From the above Lowest Volatility article, here's the scorecard for the last two recessions.

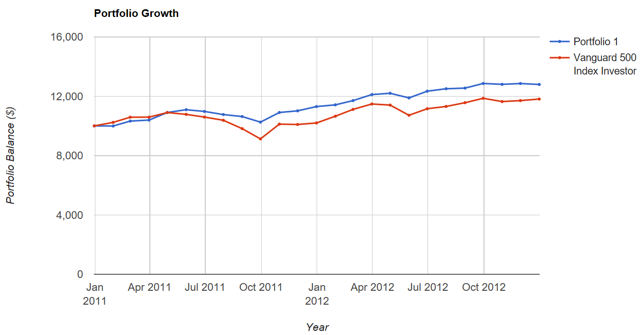

Here's how the combo held up vs. the S&P 500 in the minor correction in 2011. The period is January of 2011 to end of 2012. The chart is courtesy of portfoliovisualizer.com. In 2011, the Fantastic 4 for lower volatility was up 12% while the S&P 500 was up by just 2% and the broad market had a drawdown of 16.3%, even with dividend reinvestment.

Here's how the combo held up vs. the S&P 500 in the minor correction in 2011. The period is January of 2011 to end of 2012. The chart is courtesy of portfoliovisualizer.com. In 2011, the Fantastic 4 for lower volatility was up 12% while the S&P 500 was up by just 2% and the broad market had a drawdown of 16.3%, even with dividend reinvestment.

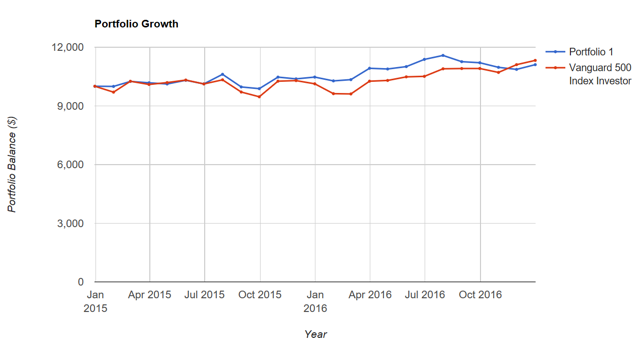

And let's have a look at the Fantastic 4 through the minor correction of 2015 and into early 2016. Once again we see the defensive portfolio hold up quite well.

And let's have a look at the Fantastic 4 through the minor correction of 2015 and into early 2016. Once again we see the defensive portfolio hold up quite well.

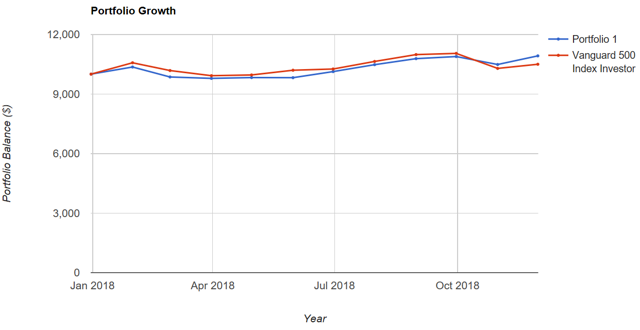

We've seen more volatility in last 2018, here's 'The 4' vs. the market. The period is January of 2018 to end of November 2018.

We've seen more volatility in last 2018, here's 'The 4' vs. the market. The period is January of 2018 to end of November 2018.

We see that in the period of the biggest market drawdown, the Defensive 4 started to 'do its thing.' For the period, the Defensive sectors were up 10% vs. 5.4% for the S&P 500.

We see that in the period of the biggest market drawdown, the Defensive 4 started to 'do its thing.' For the period, the Defensive sectors were up 10% vs. 5.4% for the S&P 500.