It's been nearly about two years since I last covered GAMCO Global Gold, Natural Resources & Income Trust (NYSE:GGN), a hugely popular closed-end fund on Seeking Alpha with over 10 thousand followers on the ticker. According to the fund's website:

GAMCO Global Gold, Natural Resources & Income Trust is a non-diversified, closed-end management investment company that seeks to provide a high level of current income. The Fund's secondary investment objective is to seek capital appreciation consistent with the Fund's strategy and its primary objective.

The Fund will attempt to achieve its objectives by investing at least 80% of its assets in equity securities of companies principally engaged in the gold industries and the natural resources industries. As part of its investment strategy, the Fund intends to earn income through an option strategy of writing (selling) covered call options on equity securities in its portfolio.

The fund uses 12% leverage (via 5.00% Series B Cumulative Preferred Shares) and charges a baseline expense ratio of 1.29%. The fund's market capitalization is $587 million and the average trading volume is 536K shares.

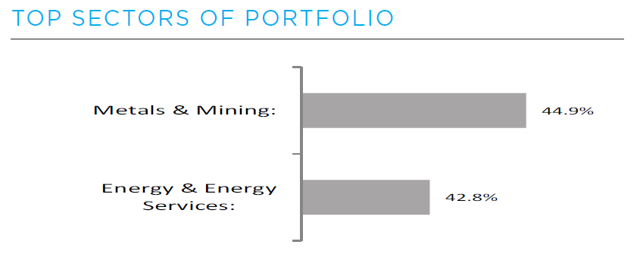

Currently, the portfolio is about evenly split between the metals & mining sector (44.9%) and the energy & energy services sector (42.8%). The remainder of the fund is invested in treasury bills.

(Source: GGN Factsheet, 9/30/2018)

The top 10 holdings of GGN are shown below and include well-known supermajors such as Exxon Mobil (XOM), Royal Dutch Shell (RDS.A) (RDS.B), Chevron (CVX) and Total (TOT) as top holdings.

(Source: GGN Factsheet, 9/30/2018)

In our last article, I made the point that GGN's 11% yield was of the destructive variety simply because the NAV of the fund could not be supported. I wrote at the time that the managers were not guiltless of maintaining an "unsustainably high distribution policy that will

We’re currently offering a limited time only free trial for the CEF/ETF Income Laboratory with a 20% discount for first-time subscribers. Members receive an early look at all public content together with exclusive and actionable commentary on specific funds. We also offer managed closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting ~8% yield. The sale has been EXTENDED for 1 more week only, so please consider joining us by clicking on the following link: CEF/ETF Income Laboratory.