After weeks of walking virtually alone on its rising path, gold is finally getting some support from some of closest allies. The silver price has begun to confirm gold’s rally, which is always a welcome sign from a bull’s perspective. Gold and silver mining stocks are also showing signs of perking up. In this report, we’ll discuss the favorable developments taking place right now and how they bode well for gold’s intermediate-term (3-6 month) outlook.

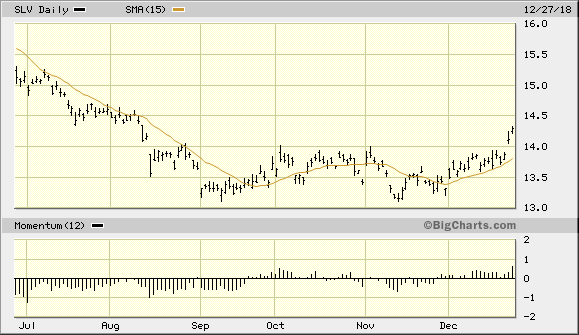

After spending the past several weeks locked in a tight, narrow range, the silver price has begun making headway in its attempt to join gold in reversing the damage inflicted this summer to the precious metals complex. In the last two trading sessions, the iShares Silver Trust ETF (SLV) - my favorite silver proxy - has broken above the ceiling of its 4½ month trading range. By closing decisively above the $14.00 level (see chart below), SLV has signaled that the white metal’s prospects have drastically improved. This implies, moreover, that the lateral trading action in silver price since September most likely represented accumulation, or buying, on the part of informed investors.

(Source: BigCharts)

The latest rally in silver also confirms the recent rally in gold price. As long-time readers of this report are aware, I consider it to be imperative that the silver price trend more or less in line with the gold price. Otherwise, if the two metals are diverging from one another, the odds are high that a gold price rally will quickly reverse.

In recent weeks, however, gold has had enough support from its “fear factor” to move higher without participation from silver. Investors have been on high alert over the suddenly tighter Fed monetary policy, as the Fed funds rate is rapidly getting closer to the yield on the 10-year Treasury bond. This fear, along with continued concerns