Depending on what kind of valuation indicator you are looking at, you can either say that US stocks are excessively overvalued or reasonably priced. It ultimately comes down to how sustainable you think current earnings numbers are in the middle term.

When making investment decisions for 2019 and beyond, we need to be very selective in US stocks, and a healthy dose of international diversification makes a lot of sense for value-hunting investors.

The Valuation Disconnect

Some widely followed valuation indicators are saying that US stocks are priced at dangerously high levels.

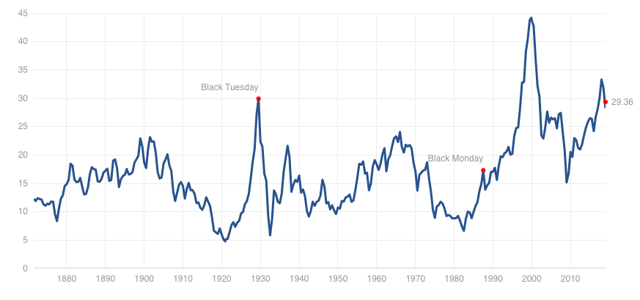

The Cyclically Adjusted PE Ratio (CAPE Ratio) is a price-to-earnings ratio based on average inflation-adjusted earnings from the previous 10 years. The indicator is currently at 29.4, and it has not been this high since the levels before the Great Depression and the Tech bubble.

(Source: Multipl)

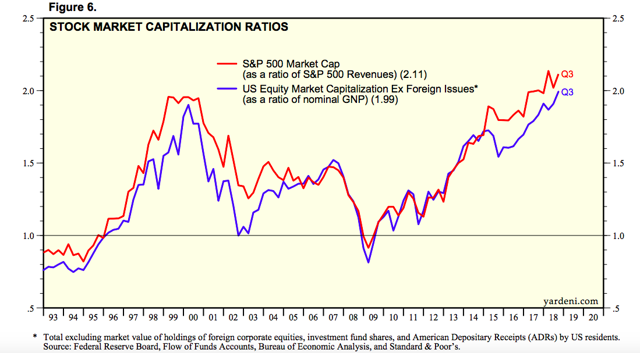

In case the CAPE ratio is not scary enough, the price-to-sales ratio looks even more extended. The market cap for S&P 500 stocks as a ratio of S&P 500 revenues, which is essentially the price-to-sales ratio for the index, is trading at historical highs, even materially above its highs from the dotcom bubble.

(Source Yardeni Research)

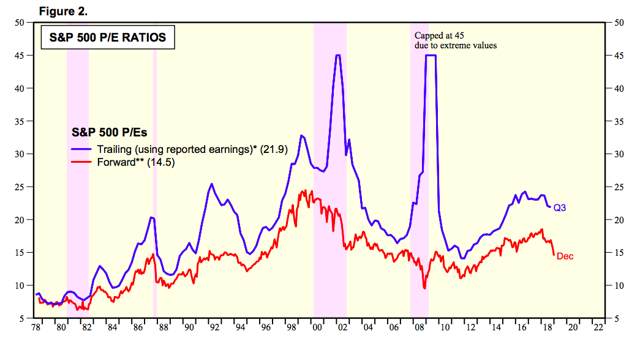

On the other hand, if we look at ratios such as trailing price-to-earnings, the U.S. stock market is not too expensive. Even more interesting, the forward price-to-earnings ratio based on 12-month forward consensus expected operating earnings is quite low, at 14.5. This is not only reasonable, but even attractive by historical standards.

(Source: Yardeni Research)

Why is it that stocks look dangerously expensive based on long-term earnings metrics and revenue, but they also look reasonably priced based on current and future expected earnings?

Profit margins are the key variable to consider. Due to relatively low wage inflation in recent years, cheap debt, cost-cutting technologies, and lower taxes, profit margins for

Alphabet and Cambria Global Value are included in our live portfolio in The Data-Driven Investor, and I also follow such a portfolio with my own personal money. Forget about opinions and speculation, investing decisions based on cold-hard quantitative data can provide you superior returns with lower risk over the long term. Click here to get your free trial now.