Biofrontera (BFRA; OTCPK:BFFTF) has been gradually shifting from a biotech company into a focused pharmaceutical company with specialization in dermatology. The central turning point was the European approval of the self-developed medication Ameluz for the photodynamic therapy of actinic keratosis in 2011. Since then, Biofrontera has made further important progress, such as acquiring the FDA approval of Ameluz in the USA. Please visit our articles Biofrontera: Potential Market Opportunities After FDA And EMA Approval and Biofrontera: Ameluz - The Key Future Value Driver to gain more insight about the company. Recently, Biofrontera has announced an unaudited report for the fiscal year 2018 with many positive results. In this article, we want to present some important growth factors for the company this year.

Biofrontera on numbers

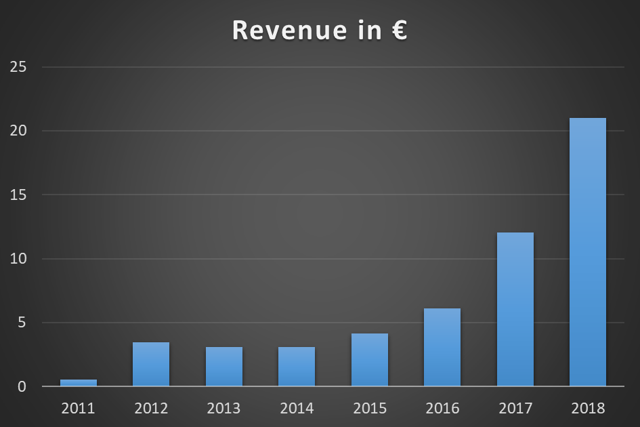

Thanks to the strong growth in the USA (+136 percent, equivalent to EUR 14.9 million), Biofrontera was able to almost double product sales. The unaudited revenue of the group in 2018 was between EUR 21 - 21.2 million, of which around EUR 6.6 million came from Q4, compared to EUR 4.7 million in the previous year period. Apart from the large growth in the US - Biofrontera's main market - the company also recorded an increase in sales in the EU. This promising result was due to the approval of Ameluz in combination with daylight photodynamic therapy (PDT).

Figure 1. Biofrontera's Exponential Revenue growth

While the revenues continued to grow significantly, operating costs were in line with the plan. Thus, the company has revised its forecast for the 2018 consolidated net income from EUR -15.0 to EUR -16.0 million to EUR -8.0 to EUR -10.0 million.

With the improved performance, break-even is within reach. Firstly, the company has successfully established dedicated teams in its core markets in order to boost sales. Besides, the gross margin from product sales is