With one product candidate at phase 3 of development, Genfit (OTCPK:GNFTF) should interest institutional investors quite a bit. The results are expected by the end of 2019, which the market should remember well. Keep in mind that beneficial results could make the share price increase quite a bit. Having mentioned this, the company may need more financing to finish other product candidates still at phase 2 of development. Investors should remember that further sale of equity to finance these trials could lead to share price depreciation in the near future.

Source: Prospectus

Source: Prospectus

Business

Founded in 1999, Genfit is a clinical biopharmaceutical company focused on the development of drug candidates targeting the treatment of metabolic and liver-related diseases. The activities of company are presented with the following terms on its website:

Source: Company's Website

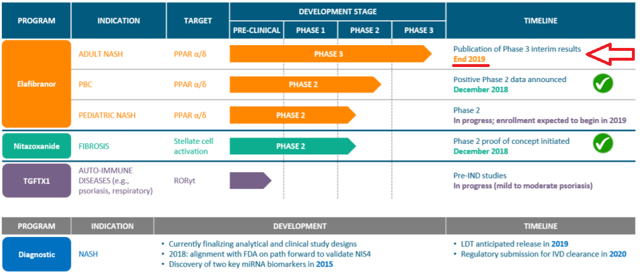

Biotech investors should appreciate the company's pipeline. The research executed by Genfit is at an advanced stage of development. Genfit exhibits one candidate at phase 3 of development, three products at phase 2 of development, and one product candidate at pre-clinical stage. The image below provides further details on this matter:

Source: Company Presentation

The company's leading candidate is elafibranor, which represents a potential treatment for nonalcoholic steatohepatitis, or NASH. With regards to potential stock catalysts, elafibranor seems interesting. As reported in the previous image, by the end of 2019, Genfit is expected to release Phase 3 interim results. If the new information is beneficial, the stock price of Genfit could spike up. Investors should remember this date.

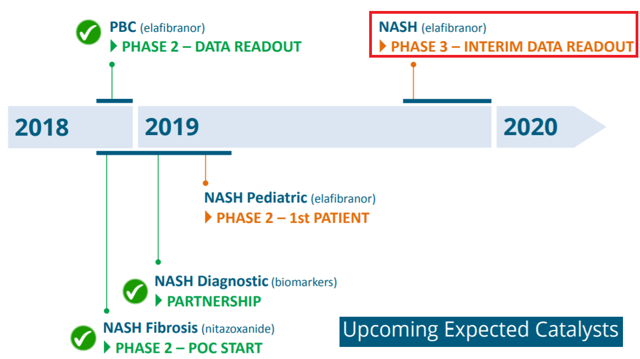

The image and the lines below provide further details about the upcoming stock catalysts and when the product candidate may be commercialized in the United States and the EU:

Source: Company Presentation

"We expect to report the results of our interim cohort analysis by the end of