Shares of Y-mAbs Therapeutics (NASDAQ:YMAB) have risen by over 25% since IPO pricing at $16 in September of last year. While the stock price briefly peaked above $30, it's come back down to a more reasonable level (performance is flat so far in 2019).

The company initially drew my attention given that much of leadership hails from Danish pharmaceutical giant Genmab (OTCPK:GNMSF) (GMXAY) and two lead programs could see regulatory submissions later this year for oncology indications of high unmet need.

The theme the company is operating in (precision medicine/targeted oncology) has been a hot one with a number of winners over the past couple years and my first glance at its JPMorgan presentation revealed significant optionality in the basket trial of B7-H3 positive CNS/LM tumors.

Chart

Figure 1: YMAB daily advanced chart (Source: Finviz)

Figure 2: YMAB 15-minute chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels to get a feel for what's going on. In the first chart (daily advanced), we can see that since IPO the stock has bounced around quite a bit and currently appears to be consolidating around the $20 level. In the second chart (15-minute), we can see a bit of weakness and selling pressure taking place (albeit on low volume). In fact, the stock trades just 66,000 shares on average daily and oftentimes much lower.

Overview

One thing that immediately sticks about Y-mAbs is that both lead programs have been granted the coveted Breakthrough Therapy Designation by the FDA, as well as Rare Pediatric Disease and Orphan Drug designations.

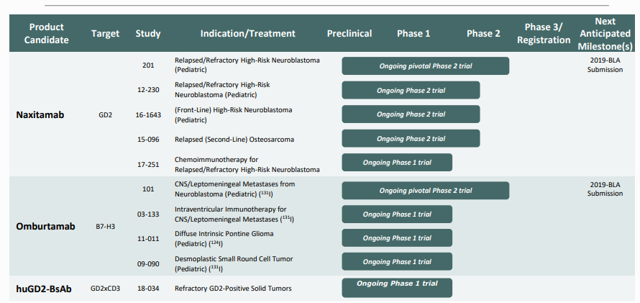

Figure 3: Pipeline (Source: corporate presentation)

Figure 3: Pipeline (Source: corporate presentation)

Naxitamab is an anti-GD2 antibody with multiple advantages over other GD2 targeting therapies, including modest toxicity (allows for 2.5x greater dose) and shorter infusion time (30

'ROTY or Runners of the Year'

ROTY is a 500+ member community which provides a welcoming atmosphere where due diligence and knowledge are generously shared. Subscription includes access to our 10 stock model account, exclusive write-ups on my favorite setups, Idea Lab, Catalyst Tracker, full archive access, a very active & focused Live Chat and much more at an affordable price point ($25/month or $200 annually).