Investment Thesis

Xylem (NYSE:XYL) offers a comprehensive suite of products in water technologies market. The firm operates through three segments, Water Infrastructure, Applied Water, and Measurement & Control Solutions. In the last five years, Xylem has delivered a 5.87% yearly sales growth on average and a 10.54% average in profit margin. One of Xylem’s core strategies is to penetrate international water technology markets, and it has been very successful so far. Combining all the factors, Xylem is a buy.

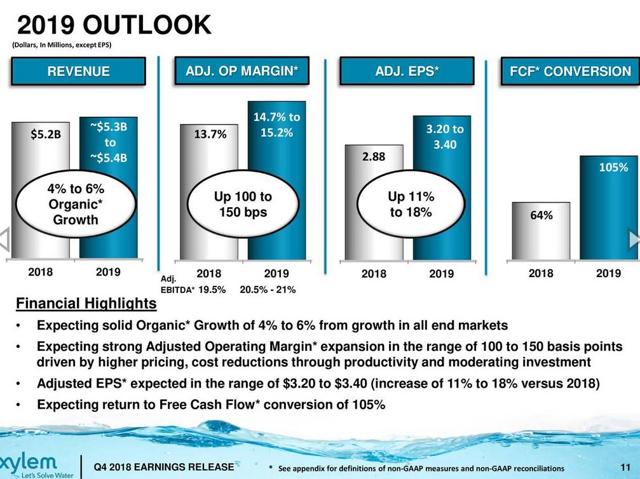

More than half of Xylem’s revenue comes from non-U.S. regions, with Europe as the highest international contributor, making up about 28% of total sales in its latest fiscal year, followed by the Asia-Pacific with a 13% contribution and the rest accounted for by other nations. This year the firm expects to launch new technologies that combine its data, analytics and software capabilities in its installed base and enable the firm to tackle challenges related to water scarcity, affordability, and resilience. In its latest quarter, Xylem announced a 14% increase in the dividend which is in alignment with the management’s plan to grow its dividend in line with earnings growth. Although the dividend is small right now, the safety is high as shown by its coverage ratios. As Xylem matures, I expect a higher yield from the firm, but right now the firm exhibits growth characteristics. The midpoint revenue guidance is 5% organic growth for 2019, adjusted operating margin and adjusted EPS are guided to expand in between 100-150 bps and 11-18%, respectively.

Source: Earnings slide

Products that rock: Flygt Concertor and Godwin FP150

Flygt Concertor is a wastewater pumping system that features integrated intelligence and creates synergy between software functions and hardware. This system can sense real-time operating conditions while adapting to the required performance and provide instantaneous feedback to the operators