In the next 48 months, the Permian basin alone is projected to surpass the daily production of the nations of Brazil, United Arab Emirates, Iraq, Iran, and China – from just one basin.

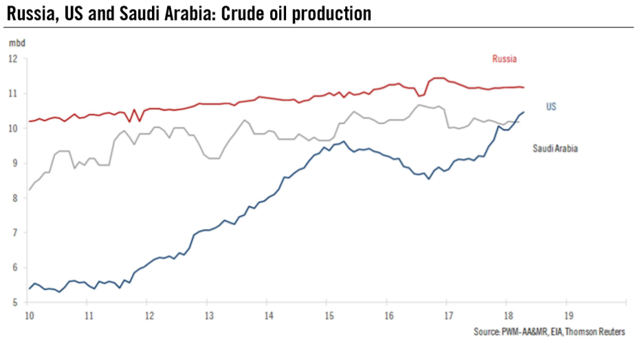

Please look carefully at this chart of the world’s current three biggest producers of oil…

I wrote the following on Seeking Alpha back in 2010, the *beginning* date for the chart above.

“When I began my career in the brokerage business in 1972, our firm’s analysts put out a report about the world running out of oil. Since then, we have more than doubled our estimates of the oil, gas and coal remaining under the earth’s crust and have barely begun to explore in parts of Africa and under the world’s seas. (A few weeks later, these same analysts also sent out buy recommendations based upon the “certainty,” then all the rage among leading scientists that, because of our addiction to fossil fuels, the planet was rapidly cooling and we were all going to freeze to death unless we developed alternatives to oil.)

Since then (2010) the United States has *again* doubled its production and more than doubled its estimates of reserves of oil and natural gas!

Make no mistake, it is U.S. shale that had delivered this good news. U.S. shale growth is turning the world’s oil and gas calculus on its head. Erstwhile providers to the world’s largest consumer markets, the United States and Europe, who reckoned they could dictate terms geopolitically because of the economics of oil and gas, are running scared and the US is in the driver’s seat.

Even those vehemently opposed to using Mother Nature’s compressed fuel in the form of highly efficient oil and gas might enjoy this good news. After all, all those billions spent kowtowing to bullying dictators sitting atop

Next month the price of a subscription to The Investor's Edge will rise to $40 per month. If you subscribe now, you can lock in the current $29/month price *and* receive an additional 5% discount. This is a limited time offer so act today!