Investment Thesis

CONSOL Energy (CEIX) is a pure-play coal stock that has been focused on deleveraging its balance sheet - with great success. Now, management is shifting gears towards future growth, making CEIX a fantastic investment.

Company Overview

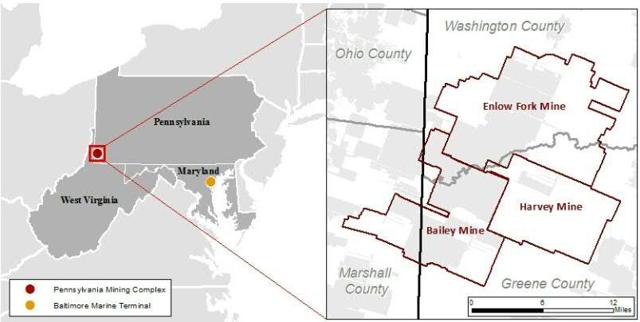

(Source: CONSOL Energy)

CEIX owns and operates a mining complex in Pennsylvania, as well as rights to mine in other regions.

(Source: CONSOL Energy)

This complex is the primary revenue generator of CEIX and is a shared operation. This complex is 25% owned by its master limited partnership, CONSOL Coal Resources (CCR). The original mine was opened in 1984, and the most recent mine began operations in 2015.

CEIX also operates one of the only two coal marine terminals on the eastern seaboard. This terminal is also services by two different rail lines, making it extreme versatile for sending coal internationally or domestically.

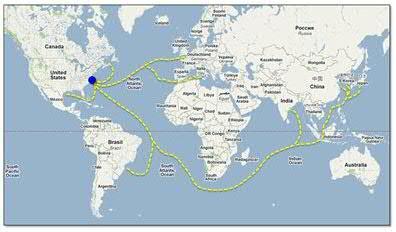

(Source: CONSOL Energy)

This terminal provides CEIX a rare opportunity to ship its goods around the world without having to pay a competitor to do so. Coal demand is lowering in the United States and Europe as countries try to diversify their energy production to alternative and renewable sources. However, CEIX readily ships its coal to the Asia-Pacific region, where demand remains strong.

(Source: BP)

Global demand for coal in "developed" countries - meaning here the United States and European countries - has seen steady decline; however, the Asia Pacific region - where CEIX has ready access to export via its terminal - has seen a share demand and consumption increase. This provides strength to CEIX financially - as demand wanes domestically, its marine terminal proves more and more vital.

Financial Check-Up

CEIX had a solid 2018. Its total sales of coal hit a company record for the year, producing and selling 5.7% more coal than 2017. Furthermore, its terminal facility