Introduction

There is little doubt that drone technology will be a big part of our future. Drones can be used for search and rescue, crop surveying, areal photography, military, border patrol and much more. What has gained the most attention and press is drone delivery. Companies like Zipline, Flytrex, Matternet, Flirtey, Amazon (AMZN) and Google (GOOG, GOOGL) are focusing on drone delivery solutions. From an investor's perspective, the challenge is finding a good leveraged investment to this new technology. The main players I have listed here are private and in the case of Amazon and Google, drone delivery is not material as an investment. This is why investors might want to pay close attention to Drone Delivery Canada (OTCQB:TAKOF). In this article I will look at three public companies in the drone delivery space.

Amazon Prime Air is still stuck in the Hanger

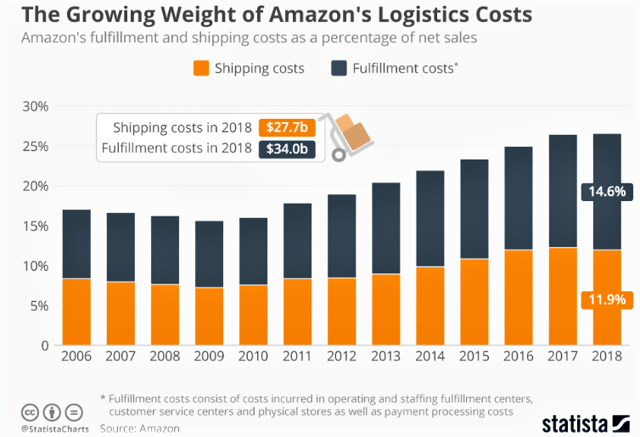

Amazon is a leader in e-Commerce sales, but they are struggling to keep their delivery costs under control. It is obvious from the chart below that Amazon's shipping and fulfillment costs have been rising steadily from around 17% of net sales to over 25%.

(Source:statista.com)

These rising costs are a real challenge. Amazon is making progress with warehouse automation and gaining more control over their delivery process, but their approach with delivery drones has a serious flaw from the onset.

On December 21, 2018, the Chicago Tribune reported that Amazon will lease 10 Boeing 767 planes, bringing its total fleet to 50 with the goal of getting orders to people faster and more reliably. Amazon acquired Kiva Systems for $775 million back in 2012 and since then has been steadily investing in a robotic future. While this is some great progress with robotics and inventory management, Amazon believes drone delivery could really improve efficiency. At this point