Note: All amounts are expressed in Canadian dollars unless otherwise stated.

Background

When it comes to the Canadian landscape for licensed producers, a name that sometimes goes under the radar is HEXO Corp. (HEXO). The company has been quite active over the last few quarters making some strategic moves and executing its growth strategy. An uplisting to the NYSE has made it bit more of a recognizable name, but we feel it deserves some more attention. We think it is well-capitalized to make additional transactions and partnerships in the cannabis space and subsequently grow its brand. At this point in time, it is worth taking a closer look at one of the lesser-known players in the industry. Its current cash position and access to capital, as well as its future market outlook, make an investment in HEXO an interesting way to diversify from the larger Canadian licensed producers.

Cash is King

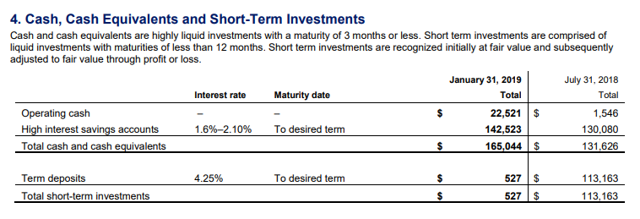

One of the most attractive components of HEXO is its current cash position and access to capital. Note 4 of its most recent January 31, 2019, quarterly statements is shown below.

Source: Q2-2019 Financial Statements

Additionally, the company had approximately $8.1M as restricted cash which is not presented in the note above nor factored into the analysis below.

It is a great sentiment when a cannabis company is able to raise funds with one of the big Canadian banks, which is what occurred with a $57.5M raise led by the Canadian Imperial Bank of Commerce (CM) and the Bank of Montreal (BMO). The raise was a public offering at $6.50 per share and reiterates confidence of the market given the participation by the big banks.

The current cash position of the company could be even stronger than as at January 31, 2019. This is due to Newstrike Brands, as discussed below, having cash