This article was co-produced with Dividend Sensei.

A while back I wrote a Seeking Alpha titled "Why Not Just Buy Vanguard Real Estate ETF (VNQ) And Be Done With It?" The article performed extremely well and I even wrote a follow-up article last year titled, "So, Why Not Just Buy VNQ And Be Done With It?"

As many on Seeking Alpha know, Dividend Sensei and I have created a partnership of sorts, so that we can cover a broad range of dividend investing ideas, not just REITs.

Specifically, we collaborate on the energy-sector, a category that is aligned with my REIT wheelhouse. Many dividend-oriented investors own REITs and energy stocks, so today Dividend Sensei is collaborating with me to write up Energy Select Sector SPDR ETF (NYSEARCA:XLE), one of the most popular energy ETFs. That’s because it offers income investors both a generous yield (3.1%) and exposure to one of the greatest secular economic trends in history, America’s epic shale oil and gas boom.

ETFs are a great choice for those seeking instant diversification to a major trend that they might otherwise know little about. But there are also downsides to owning XLE, so let’s take a look at both the pros and cons of owning this low-cost ETF vs. investing in individual energy companies, especially one of my top recommendation today for conservative blue-chip investors, Exxon Mobil (NYSE:XOM).

There’s A Lot To Like About XLE and Index Investing In General…

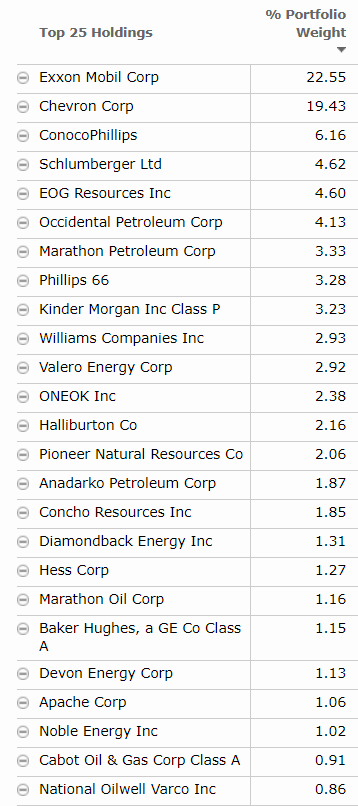

XLE is a 5-star Morningstar rated ETF that has a low expense ratio of 0.13% and yields 3.1% (about 50% more than the S&P 500). The ETF has low turnover (8% per year) and is highly tax efficient. It’s also highly concentrated into just 29 companies, almost all of them high-quality blue-chips or SWAN stocks.

(Source: Morningstar)

Invest with the #1 Ranked REIT and #1 Finance Analyst on Seeking Alpha

"Your articles should be mandatory in High schools and Colleges, as a separate subject on real estate investments."

"Always well-written, factual, and very entertaining, and you did it the hard way."

"Brad is the go-to guy, with REITs. Wonderful info, he has provided great ideas, on which I read & perform my own DD."

"Brad Thomas is one of the most read authors on Seeking Alpha and he has developed a trusted brand in the REIT sector."