(Source: imgflip)

Note that to avoid reader confusion I've shifted to a rotating portfolio update schedule. I'll now be providing just one update per week, alternating between:

- My retirement portfolio (where I keep 100% of my life savings),

- the model Deep Value Dividend Growth Portfolio (beating the market by 6.3% after 16 weeks),

- and this model portfolio made up entirely of dividend aristocrats and kings.

Introduction To The Bunker Dividend Growth Portfolio

I'm a huge fan of dividend growth stocks and dream of eventually becoming financially independent as defined by being able to live on 50% of my post-tax annual dividends alone. Being able to live 100% off passive income from a quality dividend growth portfolio is a dream shared by many of my readers.

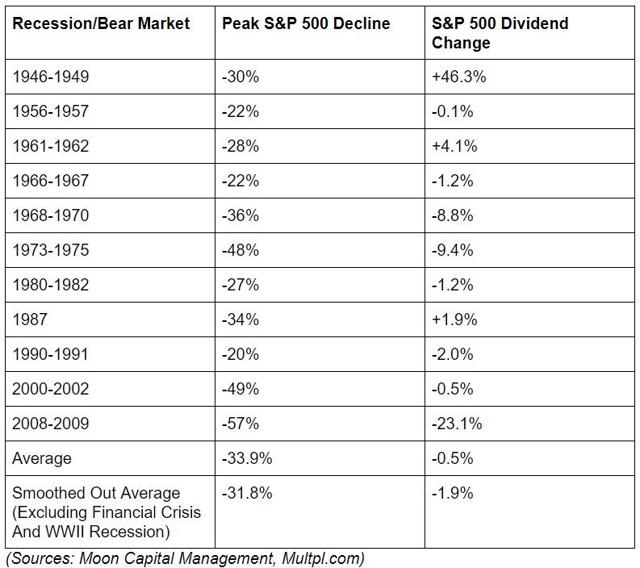

And it's not hard to see why. Historically, S&P 500 dividends have been 16 times more stable than stock prices, even during recessions and bear markets.

Thus, a well-built dividend growth portfolio can be trusted to provide you safe and even growing passive income no matter what the stock market or economy is doing. That makes it perfect for achieving your dreams of a comfortable retirement.

But wait, it gets better. Dividend growth portfolios aren't just a boring way to earn income at the expense of great total returns.

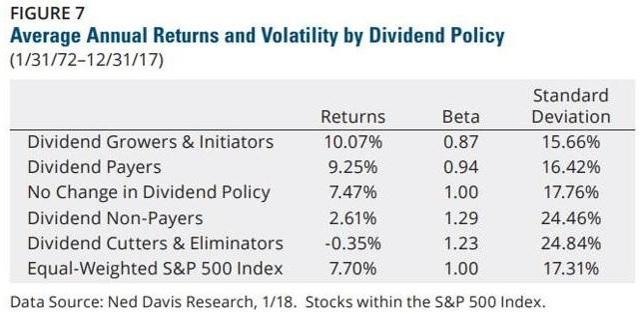

Historically, dividend growth stocks have outperformed the S&P 500 and non-dividend payers, and all while experiencing 13% less volatility to boot. But as great as dividend growth investing is, it's far from the only proven market-beating or alpha factor strategy.

(Source: Ploutos Research) - note data through March 2019

(Source: Ploutos Research) - note data through March 2019

I personally like to stack alpha factor strategies (like dividend growth, value, and low beta) so as to essentially rig the game so much in my favor that getting rich becomes purely an issue of time, patience, and discipline (to stick to time-tested