General Dynamics (NYSE:GD) is primarily known as a producer of defense equipment. The company has an aerospace division, combat division, marine division, information technology division, and a mission systems division. Each one complimenting each other in enhancing technology and offerings to provide superior products. As a producer of military equipment, the company benefits from strong defense budgets and awarded military contracts. However, the stock can be swayed if the defense budget is viewed as being cut. While some investors would consider the stock an industrial, I consider it less so due to the need for its products no matter the economic state of the country. As the shares trade far from its 52 week highs, we take a look to see how the company is performing and if the valuation makes sense to start a position at these levels.

Performance

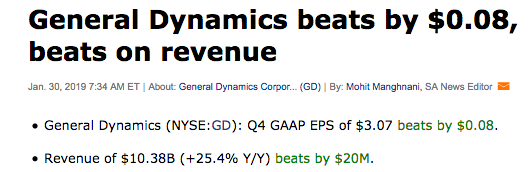

General Dynamics recently reported earnings that beat on both the top and bottom lines.

Source: Seeking Alpha

The company saw growth in every almost every operating segment which helped in see strong revenue growth of over 25%. "Aerospace" saw growth of 36.4%, "Combat Systems" saw a slight decline of 0.2%, "Information Technology" saw revenue rise 93.3%, "Mission Systems" grew 0.3%, and "Marine Systems" saw a nice gain of 11.5%.

The company saw revenue for the full year rise 16.9%, helped in part by an acquisition which lead to the strong growth in its IT division.

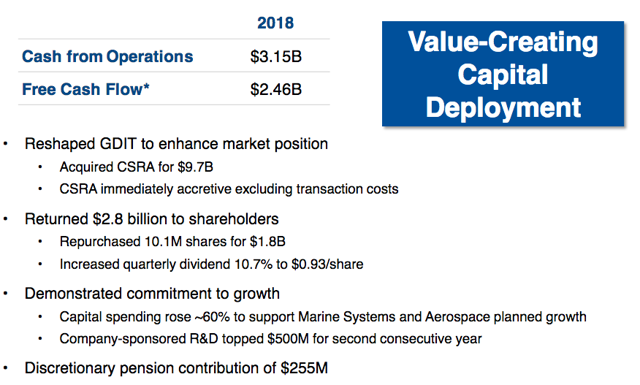

Source: Investor Presentation

These strong results would usually lead a stock to new highs and certainly create strong stock performance. The company is seeing growth of high double digits thanks to many contract wins and a strong backlog. This allows management to use its strong free cash flow to enhance shareholder returns.

Source: Investor Presentation

The backlog has grown to almost $68 billion, up almost 10% from