New Residential (NRZ) is a mREIT that has seen success. In fact, the entity has seen so much success that there isn't much room for growth. New Residential isn't a company that can continue to grow by selling products or services. New Residential is only as good as the securities it holds. New Residential can grow its mortgage origination practice, but for the most part, New Residential has reached its climax.

New Residential is Over-Valued:

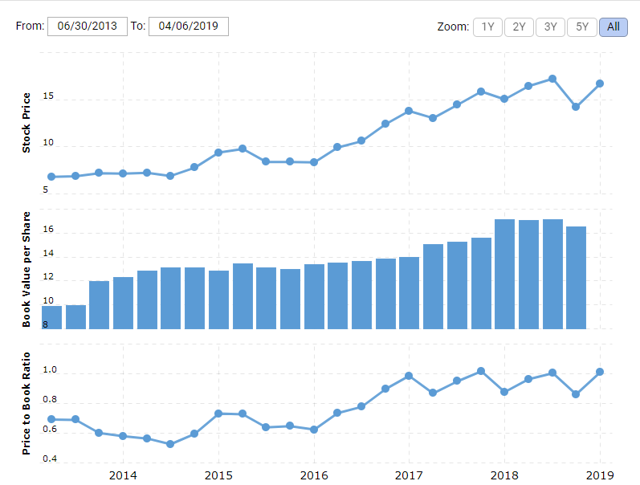

New Residential is a pricey mREIT. This isn't materializing from nowhere. New Residential is one of the few mREITs that has performed exceptionally well with rising rates. Majority of investors use price to book as a valuation metric for mREITs.

Source: Macro Trends NRZ

As you can see here, price to book is already reaching multi-year highs. There is nothing too complicated about this. Book value per share has risen slower than the price of the stock. The slowing growth of book-value brings me to my next topic.

Bleak Growth Prospects:

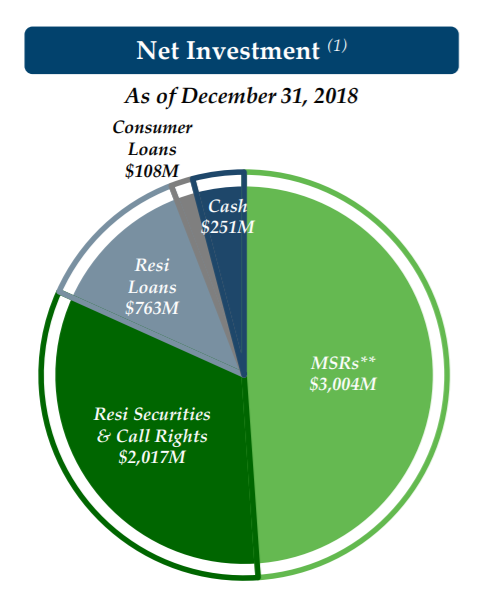

New Residential is largely comprised of mortgage servicing rights (MSRs) and residential mortgage-backed securities (RMBSs).

Source: Annual 2018 Investor Presentation

First, a quick refresher of how MSRs work and the risks associated with them.

In short, whoever services the mortgage collects a fee (usually around 30bps). Servicing includes collecting payments, dealing with delinquency, as well as other duties. As the entity is servicing, the mortgage collects payments, they give the payments to a Government Sponsored Entity or GSE. The GSE then turns around and distributes cash to the holder of the mortgage-backed security related to the mortgage being serviced. New Residential is required to make payments to the GSE regardless if they collect payment from the underlying mortgage or not. This results in an account called servicing advances. This means money is essentially loaned to the GSE. This loan is of very high credit quality, however, it does impact