Almost exactly one month ago, I wrote an article about the Energy Select Sector SPDR Fund (NYSEARCA:XLE), in which I argued that the tide was in the process of turning for energy producers and refineries. In this piece, I will update this thesis and show that the tide has indeed turned across the sector and fundamental analysis strongly suggests the energy sector is in for a rally.

As I mentioned in my last piece, the price movements of XLE largely boil down to what happens in the exploration, production, and refining sectors. The nature of the instrument allows us to examine the fundamental balances of the major commodities (crude oil, refined products, and natural gas) to generate a holistic thesis that captures the core of what is really impacting the industry. So, let’s jump in.

Crude Oil

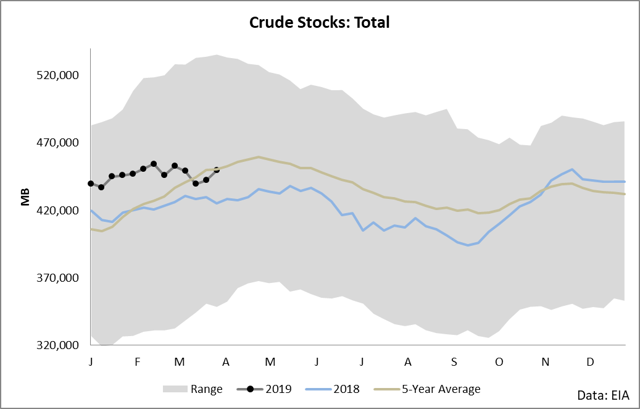

A wonderful place to start an analysis of a commodity is a 5-year range chart of inventories. This simple chart shows in one glance the supply and demand balance played out and compared to seasonal averages and norms, giving a concise picture of what is actually happening in the market.

Up until about early March, I was bearish crude oil based on the fact that inventories were oversupplied versus its 5-year average. Despite strong refining runs, the market was still out of balance, with production continuing to elevate inventory levels, which told me that the market was in for a lower-for-longer situation.

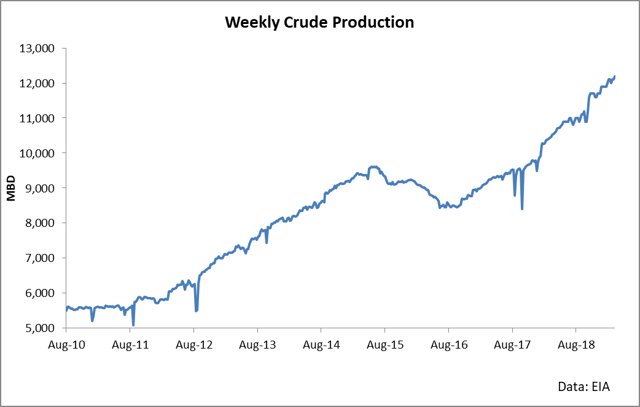

As you can see, production has remained strong and continues to climb.

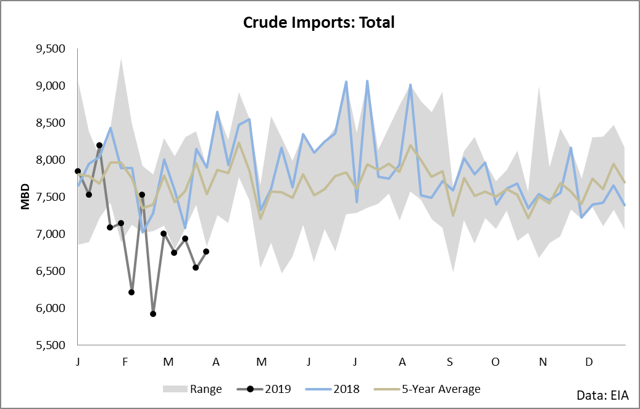

Despite incredibly strong production in which we essentially set new highs month after month, the total supply situation for the United States has been clouded in that imports have simply fallen off the face of the planet.

When examined from a standard charting perspective, the trend can be seen with