Overview

Fresh Del Monte Produce (NYSE:FDP) is the type of company anyone can understand. Founded in 1886, the company originally produced a premium blend of coffee for the Hotel Del Monte in California, transitioning into both canned foods and selling other types of fresh produce throughout the 20th century. After merging with R.J. Reynolds industries in 1979, the company was split into two entities and in 1989, Del Monte Tropical Fruit and Del Monte Foods, with the former turning into the company we know today as Fresh Del Monte Produce. As part of the split, they took the part of the business involved in selling different fruit and vegetables.

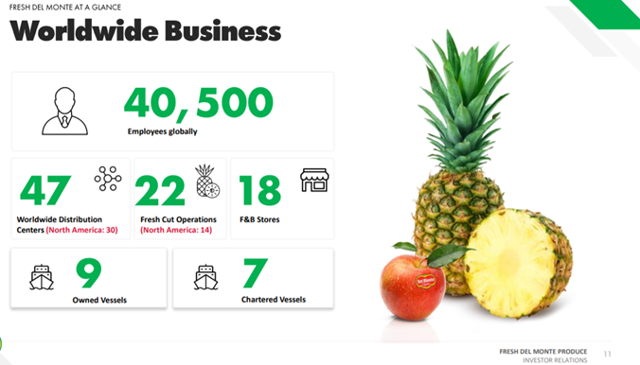

Fast forward to today and the business has grown significantly from the small operations they once had. They now employ over 40,000 people around the globe and own 47 distribution centers and 9 shipping vessels.

The business is also now far more diversified than it once was, with their main products including bananas (38%), Fresh cut products (21%) Gold Pineapples (11%), Prepared Foods (8%) and Avocados (7%).

By making prudent acquisitions, the company has been able to expand its reach globally and slowly increase its market share in its different product categories. For example, they acquired Mann Packing, a leading supplier of fresh vegetables last year, which should allow them to continue to integrate their business into all parts of the food supply chain, from producing the food to shipping it to your local supermarket.

They are now one of the biggest fresh food producers in the world and, especially in North America, are a company which millions are indirectly affected by without realizing it on a day-to-day business. They are now the biggest marketer of fresh pineapples and the 3rd biggest marketer of bananas worldwide. Because of this, they now have a very strong brand, with