The economic calendar is light so attention will again focus on Q1 earnings reports. Non-financial news will, no doubt, take center stage. The biggest market story seems to be the lack of action, as shown in our updates below. That might be fine for you and for me, but not for the punditry. They are all scratching their heads in wonderment, asking:

Why is it so quiet?

Last Week Recap

In last week’s installment of WTWA, I suggested that the general focus would be on Q1 earnings and possible confirmation of recent economic data. There was a lot of competition from important non-financial news, but the earnings stories got plenty of play.

The Story in One Chart

I always start my personal review of the week by looking at a great chart. This week I am featuring Jill Mislinski, who packs a lot of relevant information into the weekly chart without sacrificing clarity.

In an amazingly quiet week, the market was unchanged and the overall trading range less than one percent. As always, our indicator snapshot in the quant section below summarizes volatility and the VIX index in various time frames.

Personal Note

I was delighted to learn that my company, NewArc Investments, Inc. and I were in the top 25 of Advisor Perspective’s list of Venerated Voices. We are honored to be in such impressive company.

Noteworthy

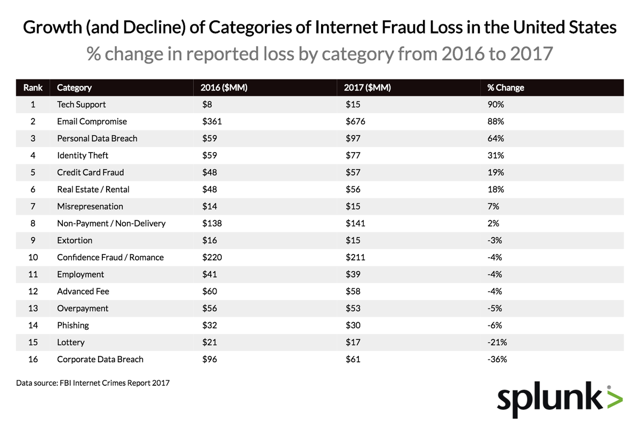

Education is one of the best ways to fight fraud. Pricenomics asks, What Kind of Online Fraud is Growing the Fastest? The post includes the expected provocative charts including this one.

#10 probably explains the changing demographic of those wanting to friend me on Facebook. Mrs. OldProf, glancing over my shoulder, commented that they did not look like the typical bridge player.

The News

Each week I break down events into good