Last year, we launched the commercial mortgage REIT Index called BLAST, that includes five of the most popular companies: Blackstone Mortgage (BXMT), Ladder Capital (LADR), Apollo Commercial (ARI), Starwood Property Trust (NYSE:STWD), and TPG Real Estate (TRTX).

We decided to create the Index as a tracking tool, so we could compare the performance with other Indexes such as the Equity REIT Index, referred to as DAVOS, and the Net Lease REIT Index, referred to as SWANO.

As you can see, the BLAST (commercial mortgage REIT Index) has returned 13.0% year-to-date, compared with 12.6% YTD for the SWANO (net lease REIT Index) and the DAVOS (Equity REIT Index). We cover a wide range of Commercial Mortgage REITs that include the following:

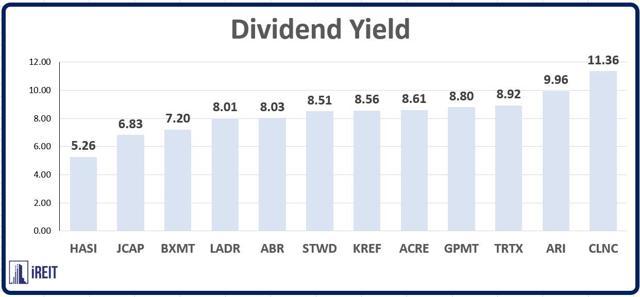

As you can see, these REITs offer a wide variety of dividend yields, ranging from 5.26% for Hannon Armstrong (HASI) to a yield of 11.36% for Colony Capital (CLNC).

Remember that Commercial Mortgage REITs are different from Equity REITs because they do not own real estate, most operate by originating commercial mortgages (some of them also own real estate: STWD, LADR, and ARI, for example).

Commercial mortgages are usually floating rate loans, meaning they're tied to LIBOR, and this means that usually profit in a rising rate environment. These days, there is a strong demand for CRE debt capital, driven by a high volume of over-leveraged and near-term loan maturities that provide for strong transaction volume fueled by improved economic conditions.

The commercial mortgage REIT sector can be further broken down into two categories: pure balance sheet lender and balance sheet/conduit lender.

A pure balance sheet lender originates or purchases loans for their own balance sheet and holds these loans on their balance sheet (although they may sell participation units in the loans to diversify some of the risks). Examples include Blackstone

Invest with the #1 Ranked REIT and #1 Finance Analyst on Seeking Alpha

"Your articles should be mandatory in High schools and Colleges, as a separate subject on real estate investments."

"Always well-written, factual, and very entertaining, and you did it the hard way."

"Brad is the go-to guy, with REITs. Wonderful info, he has provided great ideas, on which I read & perform my own DD."

"Brad Thomas is one of the most read authors on Seeking Alpha and over he has developed a trusted brand in the REIT sector."