What I had called a potentially "tense earnings day" for Houston-based Halliburton (NYSE:HAL) ended up being much more uneventful than I originally expected.

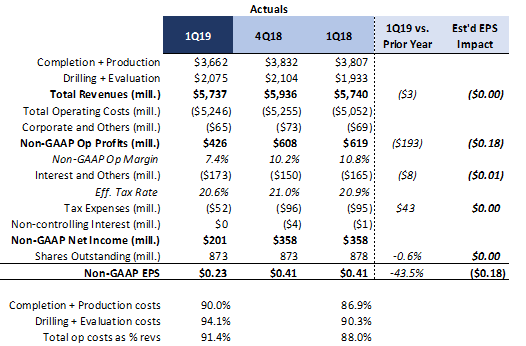

On Monday, the leading oilfield services company reported a modest revenue beat, accompanied by consensus-meeting adjusted EPS of $0.23 that helped to ease concerns over a deteriorating North America market. Probably most reassuring was the management team's vision for the rest of the year, which included the following remark:

We believe the worst in the pricing deterioration is now behind us. For the next couple of quarters, I see demand for our services progressing modestly.

Credit: Houston Chronicle

In my view, the more upbeat narrative is a departure from what peer Schlumberger (SLB) discussed a mere few days ago. On Thursday, the main competitor spoke of "lower investments with a likely downward adjustment to the current production growth outlook" in North America, as well as of "lower investments, increasing technical challenges from well interference, step out from core acreage and limited further growth in lateral length and proppant per stage."

On the Halliburton side, it was no surprise that international operations (43% of total company sales this quarter) picked up the home continent's slack, producing a solid 11% YOY increase in revenues. I calculate that Latin America alone, the smallest geographic segment, accounted for more than half of the company's top-line growth ex-North America, propelled mainly by strength across the board in Mexico and Argentina.

Source: DM Martins Research, using data from press release

But this is not to say that North America severely underperformed. Despite the noticeable 7% segment revenue dip YOY, the top-line results in the region came in roughly $150 million above consensus expectation, which is an impressive feat. Pricing seems to have been a drag still, particularly in onshore stimulation services. However, activity appeared to be relatively

Members of my Storm-Resistant Growth community will continue to get updates on SLB (allocation updates, insights, etc.) and the performance of my "10% Yielder" portfolio on a regular basis. To dig deeper into how I have built a risk-diversified strategy designed and back-tested to generate market-like returns with lower risk, join my Storm-Resistant Growth group. Take advantage of the 14-day free trial, read all the content written to date and get immediate access to the community.