Even from its earliest days, Slack Technologies (SK) was almost marked as an instant success. Having been backed years before its public launch by venerable titans of the VC world including Andreessen Horowitz and Accel Partners, Slack's success was more or less a self-fulfilling prophecy. Alongside names like Uber and Airbnb, Slack's IPO has long been one of the most-awaited public offerings among unicorns, and in late April, the company finally filed its S-1 registration documents.

Most of us have already heard of Slack. The company was built on an idea that email was static and outdated, and that modern teams needed a more agile chat and collaboration tool in order to work effectively together. Slack is primarily an enterprise software company - though it certainly sells to smaller teams and startups, the lion's share of its revenues is concentrated among major blue-chip corporations, including IBM (IBM) and Autodesk (ADSK).

What is most impressive about Slack, needless to say, is its incredible growth rate. Slack clocked revenues of just over $400 million last year, yet its pace of revenue growth is almost 2x. For comparison, Box (BOX) - another enterprise software titan which is hovering around the half-billion annual revenue run rate - has seen its growth rates dip to the ~20% range.

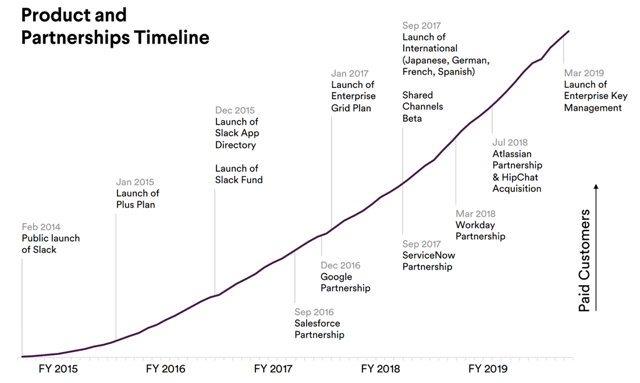

It's also worthwhile to note that Slack is a relatively young technology company, having only publicly launched in February 2014. Since then, it has grown into a multinational enterprise software giant and a category-leading application within the collaboration and workflow segments. See Slack's timeline below, taken from its S-1 filing:

Figure 1. Slack timeline Source: Slack S-1 filing

Source: Slack S-1 filing

Also good to understand is Slack's history of VC funding. It raised its first seed round of just $1.5 million in early 2009, led by Accel (which is Slack's biggest shareholder, with a whopping 24% stake