In a low interest rate environment, many investors are left seeking high yielding stocks as a means to generate income streams. The need for dividend yield can sometimes bring trouble as some dividend paying stocks yield a high amount because of underlying risks within the business. An example of this is Briggs & Stratton Corporation (BGG). Despite a generous 4.49% yield, Briggs & Stratton is ripe with risk. The business has taken a sharp downturn, and the financials are not poised to support the dividend payout. While the dividend yield may attract investors, we feel that a dividend cut is likely to happen in the near future.

At first glance, Briggs & Stratton can offer investors some attractive qualities that may be appealing at face value. The stock is trading at just over 12X 2019 estimated earnings per share, a steep discount to the S&P 500 (trading at more than 22X earnings). The dividend's current yield of 4.49% is well above what investors can get from 10 year US treasuries (2.53%). The low earnings multiple and high yield can be tempting for investors seeking a value trade, or an income producing high yielder. However, upon closer review, the waters within Briggs & Stratton are treacherous.

At first glance, Briggs & Stratton can offer investors some attractive qualities that may be appealing at face value. The stock is trading at just over 12X 2019 estimated earnings per share, a steep discount to the S&P 500 (trading at more than 22X earnings). The dividend's current yield of 4.49% is well above what investors can get from 10 year US treasuries (2.53%). The low earnings multiple and high yield can be tempting for investors seeking a value trade, or an income producing high yielder. However, upon closer review, the waters within Briggs & Stratton are treacherous.

The business has taken a very sharp turn lower over the past several quarters. Headwinds exist across multiple areas of the company. In the US, the company has been impacted by the bankruptcy of Sears. In Australia and Europe, sales have been hurt by extended stints of poor weather. The company's most recent quarter saw sales fall 4% Y/Y.

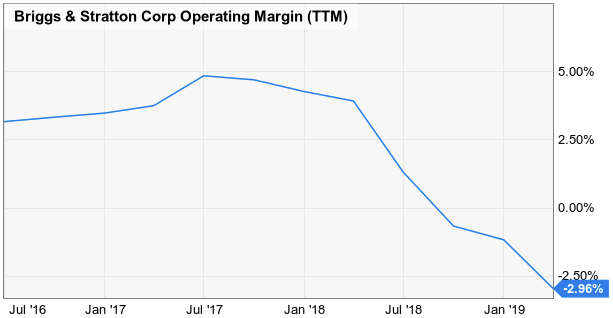

Where the company has especially struggled has been its margins. Since the summer of 2017, what were already thin operating margins (peaking near 5%) have since plummeted.

source: Ycharts

source: Ycharts

Margins have been squeezed by a number