Fox Corp. (NASDAQ:FOXA) (NASDAQ:FOX) and The Walt Disney Company (DIS) recently closed their $71B deal, handing the bulk of the former Twenty-First Century Fox's assets to Disney, freeing both companies to go their separate ways. I advised investors to buy the post-deal dips in both companies, which has worked out well so far for Disney after its Investor Day on April 11th, where it made new all-time highs as Disney's future looks brighter than ever.

Now Fox has its earnings report scheduled for May 8th, 2019 with its Investor's Day to follow on May 9, 2019. Fox could be in line for a nice bump in share price as well as it unveils its future plans as many investors will wait to see what the company says before buying into the company's future story.

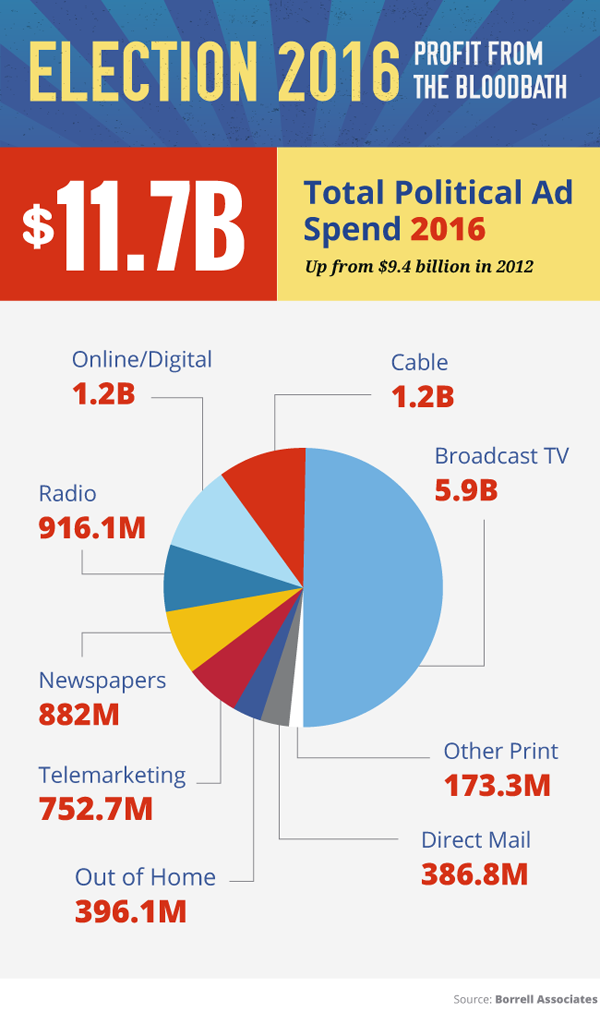

Fox is in a great position to benefit from the advertising dollars associated with the U.S. Presidential election cycle which happens every 4 years and will be concluding towards the end of 2020. Potential candidates are already announcing candidacy and attending Town Halls as Fox's News channel finished up April as the number one network in all of cable for the 34th consecutive month in total day and primetime viewership. Fox is looking to grab advertising dollars from all walks of the political spectrum as its primary viewership usually is a conservative base while it is also hosting Town Hall events for many democratic and liberal candidates including Bernie Sanders, Kirsten Gillibrand, Pete Buttigieg, and others.

Slide from Borrell Associates

The upcoming political cycle could be a lucrative time for Fox as it could start to transition to more of a digital streaming and distribution model in coming years as it announced that its new FOX Media Center will be built within the Arizona State University's