As all of you know, the shale era of oil & gas production has brought an abundance of supply to the market, as well as many years' worth of proven reserves. The result is that U.S. oil producers are highly dependent on foreign countries like Saudi Arabia and Russia to cut production in order to make room for growing U.S. production to elbow into the global export market without cratering the price. In addition, instead of the historical handful of large U.S. companies producing significant volumes of oil & gas, the U.S. now has dozens and dozens of companies producing meaningful quantities of oil & gas. So what we have today in the energy sector is a "no moat" investment proposition (see my Seeking Alpha piece "Energy Companies' Big Problem: There's No Moat").

As all of you know, the shale era of oil & gas production has brought an abundance of supply to the market, as well as many years' worth of proven reserves. The result is that U.S. oil producers are highly dependent on foreign countries like Saudi Arabia and Russia to cut production in order to make room for growing U.S. production to elbow into the global export market without cratering the price. In addition, instead of the historical handful of large U.S. companies producing significant volumes of oil & gas, the U.S. now has dozens and dozens of companies producing meaningful quantities of oil & gas. So what we have today in the energy sector is a "no moat" investment proposition (see my Seeking Alpha piece "Energy Companies' Big Problem: There's No Moat").

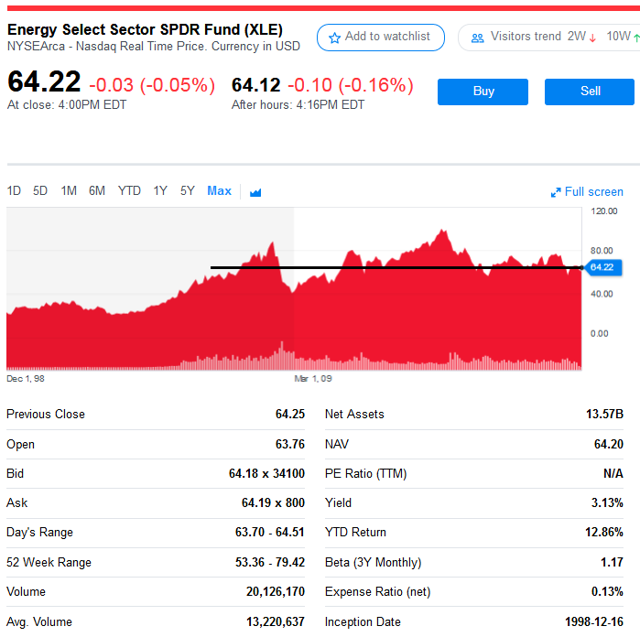

Indeed, the "no moat" era of shale oil has led to abysmal returns in the S&P energy sector: 2.6% over the past decade. Former bellwether and leader Exxon's (XOM) stock is below where it was 12 years ago. The broader energy sector, as measured by the Energy Select Sector SPDR ETF (XLE) hasn't done much better over the past decade:

Source: Yahoo Finance

Source: Yahoo Finance

Low oil & gas prices, commodity price volatility, high capital intensity, tone-deaf management, lack of free cash flow generation, and concerns of a lower carbon future are all reasons for the energy sector's under-performance.

However, there are some companies which have figured out how to thrive in the current environment by generating tremendous free cash flow ("FCF") even in a relatively low-price environment. Two of those companies are upstream leaders Cabot Oil & Gas (COG) and ConocoPhillips (NYSE:COP). Yet even these two stocks are arguably significantly under-valued. Why? Because both are upstream (only) producers and neither wants to get locked into a high dividend