Even though crude prices have been falling recently, with investors racked by fears regarding global growth and rising US output, new data coming out suggests that any real degree of pessimism is misplaced. Thanks to a new report, courtesy of the EIA (Energy Information Administration), it is looking a lot more like this year will result in a global oil deficit and, next year, while leaning toward a surplus, will not be so bad as to warrant a downturn in prices. If anything, when all of the data is taken together, it looks more and more like investors in this space should be bullish, not bearish, because in any scenario where the global economy does not weaken, crude prices should likely rise from here as inventory levels, at worst, stay nearly flat, and at best, decline some moving forward.

A look at production

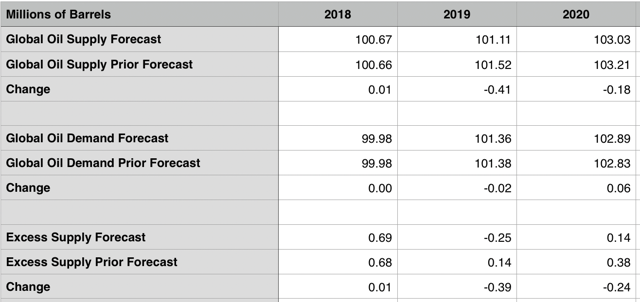

In the table below, you can see some production and consumption data I collected from the EIA's Short-Term Energy Outlook. The current forecasted data for each category covers the most recent info available, while the prior forecasted data covers what the EIA reported a month ago. What you can see by looking at this is that, if its estimates are correct, global oil production will continue rising this year and next, but the amount of output globally on a daily basis will be lower than anticipated in April.

Created by Author

For instance, global supply this year should come out to around 101.11 million barrels per day, up 0.44 million barrels per day compared to 2018, but down 0.41 million barrels per day from the 101.52 million barrels per day previously forecasted. In short, for this year, the amount of oil production growth forecasted has been cut by nearly half in just one month's time. This will carry over into next year, it seems, with output

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!